Yen Weakness Continues

The risk of fresh BOJ intervention in FX markets is growing today as USDJPY continues to ramp higher. The pair is now close to fully undoing the more than 13% decline we saw on the back of the BOJ’s double tightening measures in July. Having touched lows of 140 from around 160 prior, the pair is now back up to 156.

BOJ Yet to Act

Japanese officials have been fruitlessly jawboning the recent rally, with BOJ policymakers warning that they continue to watch the market and assess the impact of the domestic economy. However, on the back of a series of unchanged rate decisions from the BOJ, the Yen remains heavily weaker with the USD rally looking unstoppable currently.

Trump & Fed Driving USD

Looking ahead, USDJPY looks vulnerable to a further push higher given the Trump-driven USD rally underway and a dip in Fed easing expectations. Yesterday, US inflation was seen rising again to 2.6% last month. With traders now pulling back their Fed easing forecasts over coming months, USD has room to continue higher. With Trump then set to take office in January, a first look at his proposed policies is likely to spur additional USD buying. Traders will now be looking to Fed’s Powell who speaks later today. Unless we hear some firm pushback against a stronger USD, the Dollar looks likely to continue higher into next week.

Technical Views

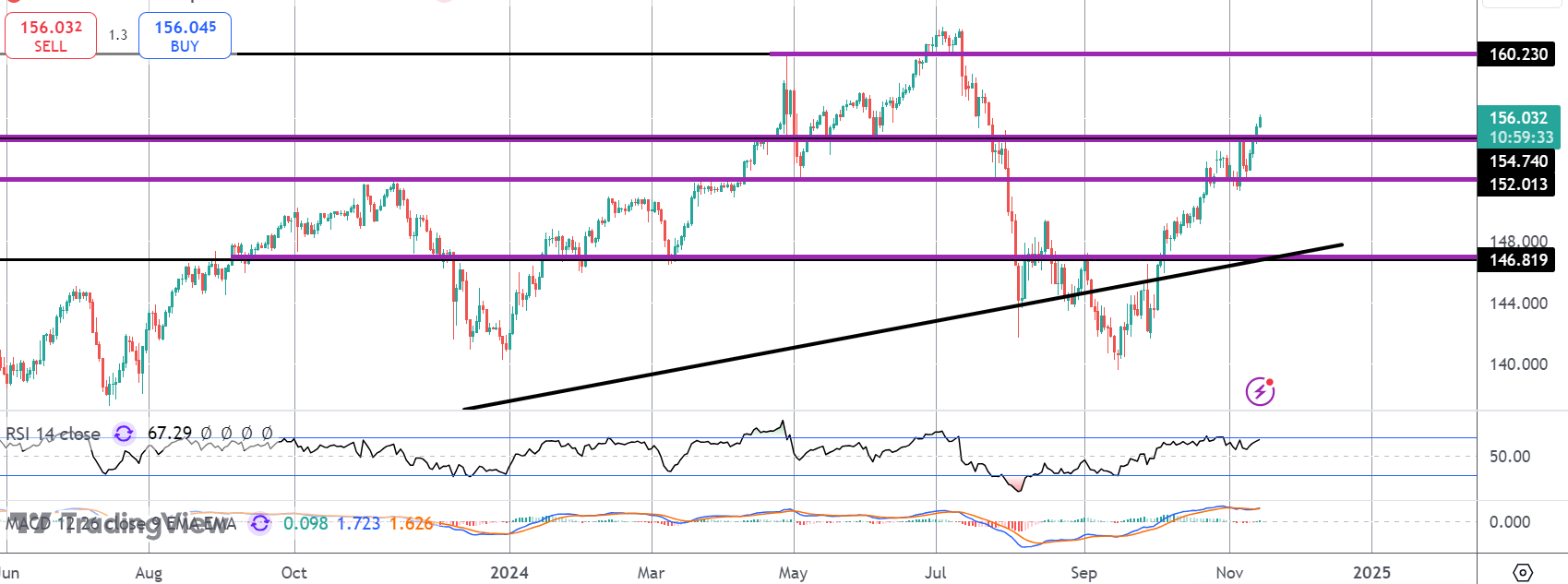

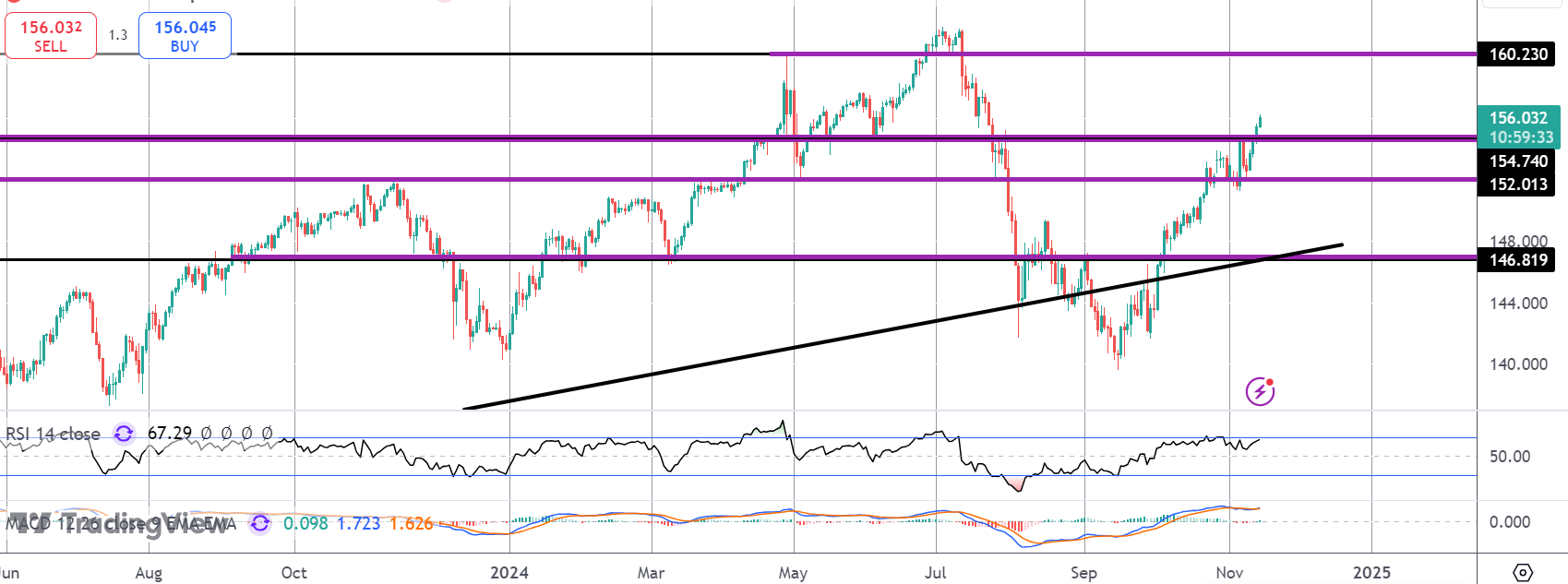

USDJPY

The rally in USDJPY has seen the market breaking above the 152 and 154.74 levels. While above here, and with momentum studies bullish, the focus is on a further push higher and a test of the 160-level next, completing the reversal of the decline over summer. To the downside, 146.81 and the bull trend line remain the key longer-term support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.