What About the China Recovery?

Over the past couple of weeks, market expectations have gradually been freed from the association of coronavirus exclusively with China, however, successfully replacing it with the theme of a global pandemic. In light of weakening of market attention to China and the release of the February manufacturing / non-manufacturing PMIs, which, by the way, have painted severe depression, it is interesting to look at some alternative high-frequency indicators of economic activity in China to understand whether there are early signals or signs of economic recovery (= optimism). In addition to rumored coordinated response of the world Central Banks, signals of recovery of the second largest economy, in my opinion, is a necessary component of stable positive market mood.

Here is a brief recap of what happened with the February activity in China's production / services sector:

Production PMI: 35.7 points with a forecast of 45.0 points;

Non-production PMI: 29.7 points with a forecast of 50.0 points.

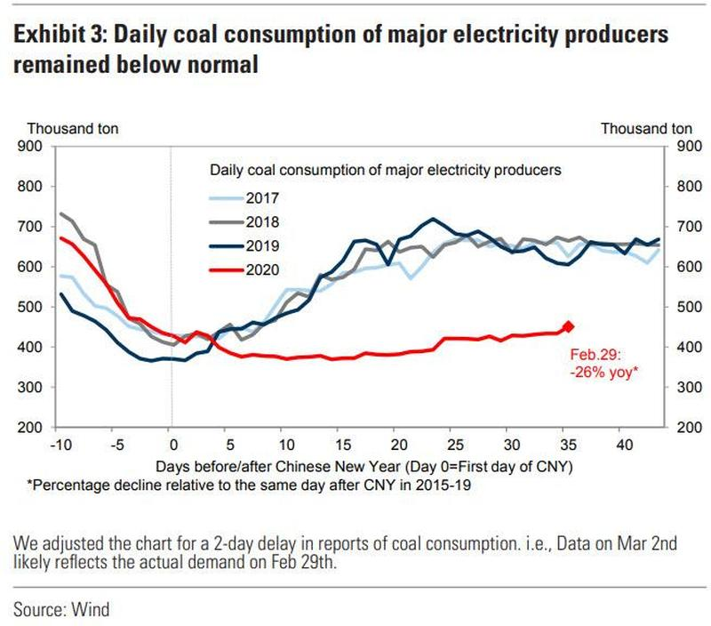

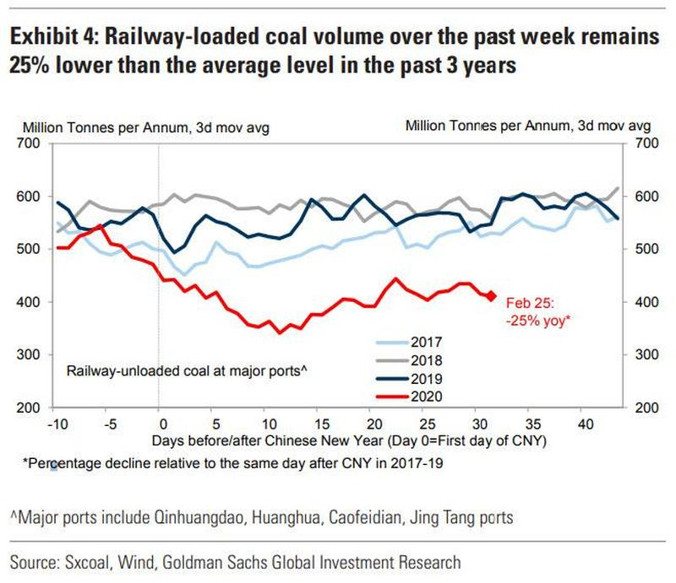

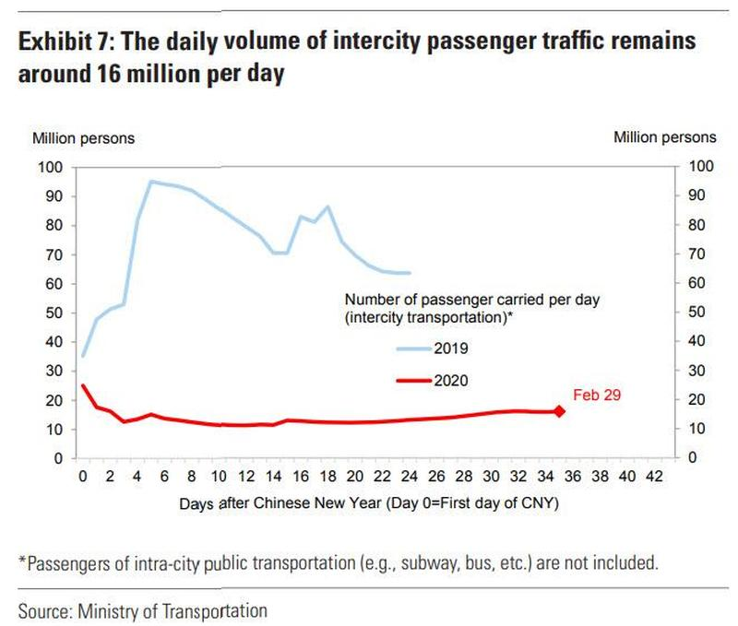

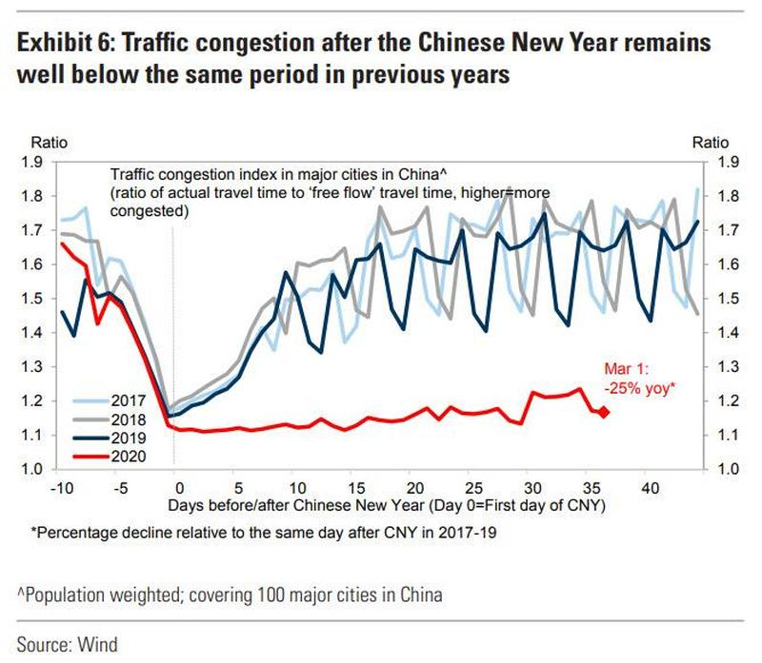

Bearing in mind that China has been easing restrictions throughout the country, the rate of recovery in production should shed light on whether there is any significant long-term damage (hysteresis) or the downturn in economic activity is mostly a fallout of lockdowns and can be followed with something like V-shaped recovery. To gauge the effect of easing lockdowns on production recovery trend official government figures may be way too lagging: as Goldman argues, we can use more “frequent” data such as coal burning, railway coal loading volumes, traffic congestion or passenger intercity transportation volumes as closely correlated variables. Below are four charts for those indicators.

Coal burning for electricity production:

Coal loading volumes for rail transportation:

Volumes of intercity passenger traffic:

Traffic congestion index:

All four metrics show rather muted response to relaxed lockdowns touted by Chinese government which clearly suggests there is a hysteresis effect and it may be significant. This is a big risk not only for local but also for foreign firms which are probably forced to put off production plans. There are even rumors circulating that the Chinese authorities ordered to increase electricity generation and leave the lights on in the factories so that satellite China images can not be used as a proxy of production resumption trend which is probably a key to understanding the prospects of global recovery.

To recap: the high-frequent data discussed above combined with stock markets leap suggests protracted China slowdown may not be fully priced in, the risk of a downward revision of Chinese GDP for the first quarter is rising. Concerns about sustainability of recent market rebound seems absolutely justified.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.