BOJ to Hold for Now

USDJPY is rallying today on the back of comments from BOJ governor Ueda this morning. At a speech to business leaders in Osaka, Ueda said that the BOJ has room to wait and assess incoming market information before moving again on rates, signalling that the bank is in no rush to hike rates again.

October A Key Month

Ueda explained that October is a key month for service-price revisions in Japan and warned that while some elements can be estimate din advance, the bank will need to wait to assess all incoming information ahead of its next policy meeting on October 31st.

Two-Way Risks

While Ueda stressed that the bank has room to wait before hiking rates, he was keen to reaffirm the BOJ’s commitment to tightening further if necessary. Ueda signalled that the bank won’t hesitate to hike further if inflation accelerates again. However, he caveated this message by saying that there are plenty of risks in the bank’s outlook currently linked to market volatility and the threat of a US recession emerging.

BOJ Warning

These comments echo those at the recent BOJ meeting where Ueda warned of weaknesses in the economy which need to be monitored. Consequently, traders have scaled back their near-term BOJ tightening expectations, leading JPY lower for now.

Technical Views

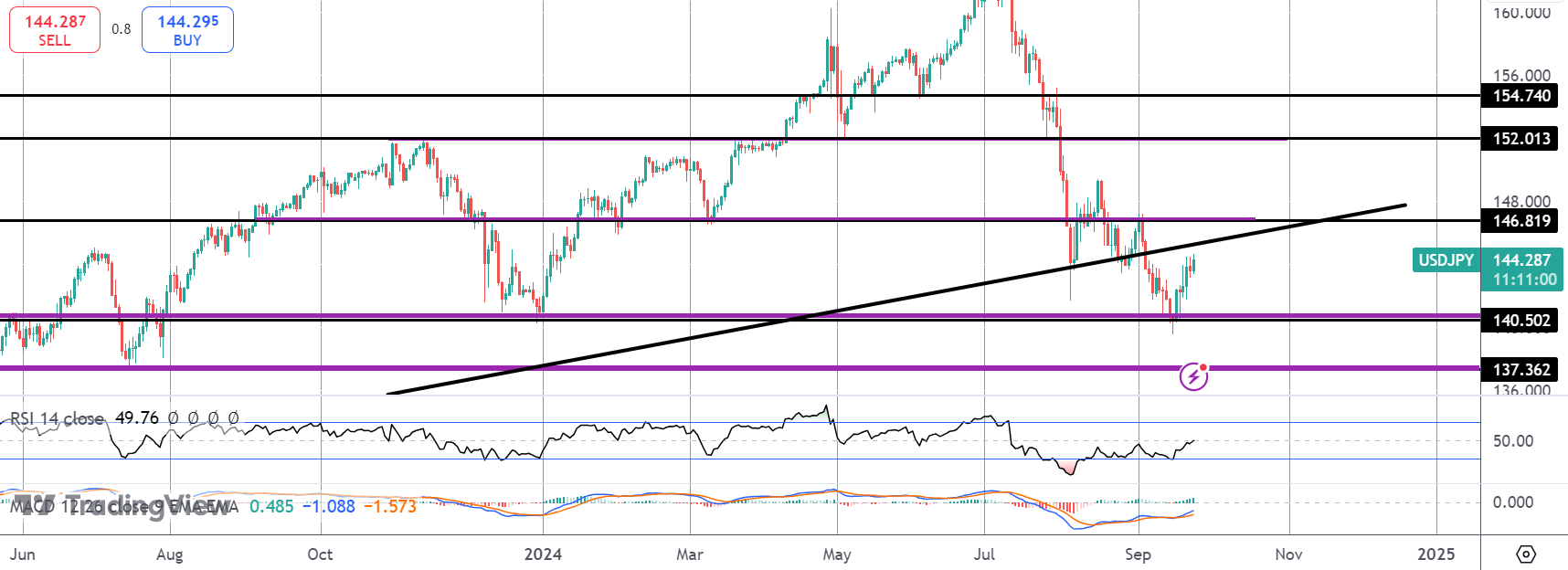

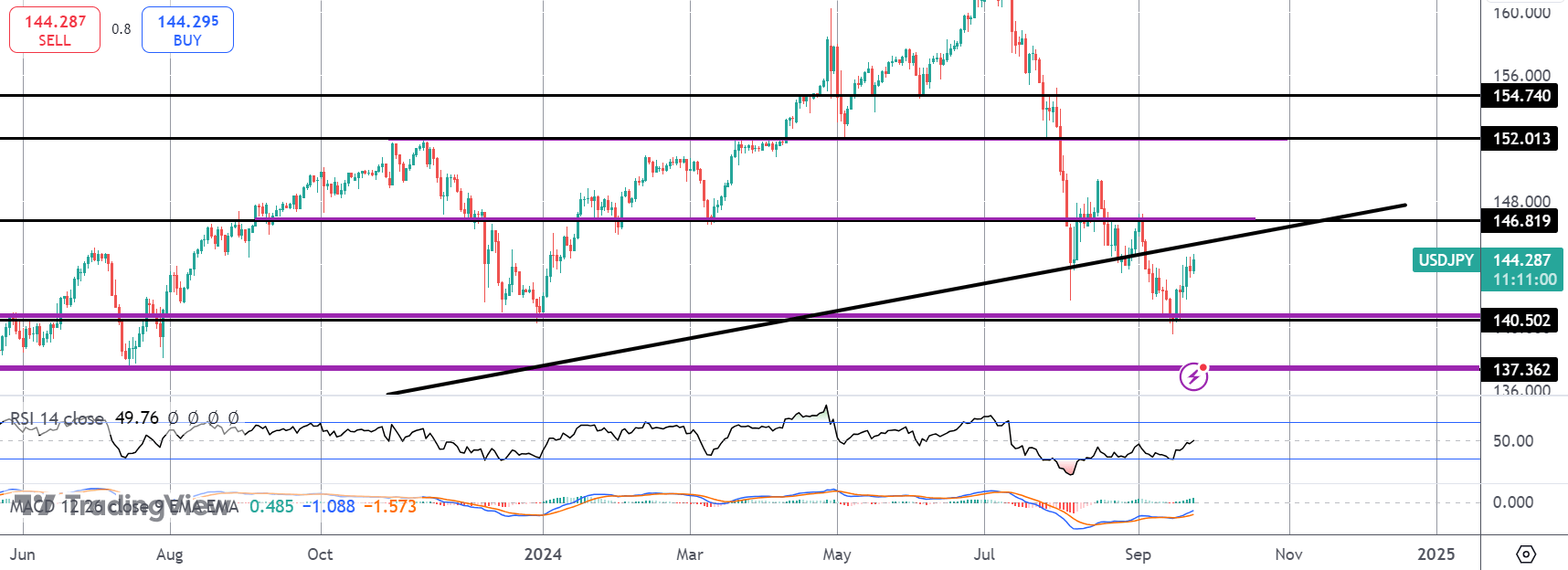

USDJPY

The sell off in USDJPY has stalled for now into a test of the 140.50 level support. Price is bouncing firmly here though remains below the broken bull trend line and 146.81 level. While below here, risks of further downside remain. Back above, 152.01 will be the next bull objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.