US Inflation Report Brings No Surprises; DXY Appears Primed for Retracement

On Wednesday, the US Dollar shows signs of slight retracement, although retaining the potential for further gains as higher US yields continue to bolster its momentum. Market sentiment around the "Trump trade" is gradually becoming more entrenched, while expectations for another Fed rate cut in December have started to wane, further supporting the Dollar's upward trend.

Today’s US Consumer Price Index report for October, one of the week's primary economic highlights, landed squarely within expectations. This lack of deviation from forecasts kept the Greenback’s response muted, reflecting the stable inflation environment rather than prompting any directional move.

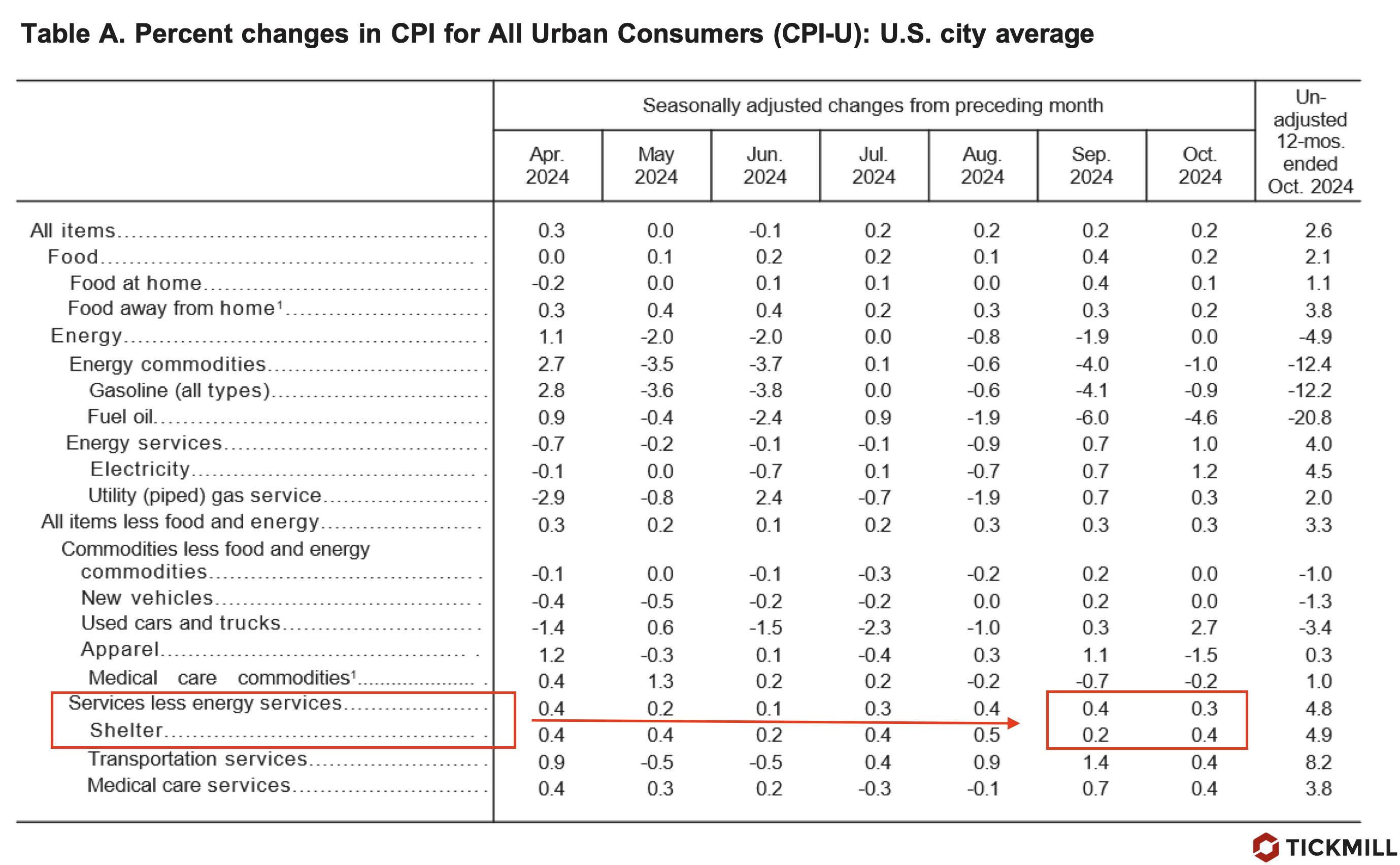

The CPI data offered few surprises:

- Monthly headline inflation held steady at 0.2%, with the annual rate nudging up slightly to 2.6% from 2.4%.

- Core inflation, excluding food and energy, remained unchanged at 0.3% month-over-month, with the annual rate steady at 3.3%.

However, examining price shifts in the most persistent inflation categories, especially those likely to generate secondary inflation effects—namely services inflation and its major component, shelter—we observe that the month-over-month change in services inflation only slightly eased, from 0.4% to 0.3%. In contrast, shelter inflation accelerated from 0.2% to 0.4% MoM. Given shelter’s substantial weight of over 30% in the CPI calculation and its characteristic stickiness, stemming from medium- to long-term contracts, this report may signal to markets that the disinflation trend either stalled or even slowed in October. This interpretation could reduce expectations for a December rate cut by the Fed, likely resulting in a bullish effect for the Dollar:

Equity markets, both in Europe and the US, remain directionless following Tuesday’s subdued performance, showing only marginal shifts as they absorb the data.

Meanwhile, interest rate futures indicate a 78.9% probability of a 25-basis-point rate cut by the Fed in December, up from levels seen yesterday (41.3%), as lack of surprises in the CPI report cleared concerns about Fed policy error.

Following the CPI release, the US 10-year Treasury yield edged lower, trading around 4.38%. While the Fed’s data-dependent stance keeps rate cut expectations in play, softening odds point to underlying strength for the Dollar as yields and data-driven expectations continue to anchor its performance.

A look at the DXY daily chart shows mounting technical bearish pressure, which may temper the index's short-term upward momentum after hitting two key bullish milestones: breaking out above the price channel's upper boundary and reaching the horizontal resistance level at 106. For further gains, some cooling of the recent rally appears necessary, likely prompting a pullback toward the 105.50 or 105.30 levels. This retracement could allow the market to reassess the potential for new medium-term highs:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.