Trade of the Week

GBP: Outperformed all G10s and advanced a whopping 1.55% week over week to 1.2526 against the USD, lifted by improving Brexit sentiments as European Commission President Juncker’s comment raised hope of a soft Brexit. Bank of England’s abstains from turning dovish also somewhat helped support the sterling this week. Brexit sentiment soured on Friday as the Irish Deputy Prime Minster cast doubt over the backstop solutions suggested by the UK government, hence my view turns near term bearish GBP in the week ahead. Data is sparse in the UK this week, the data bag comprises of key British manufacturing gauge, the CBI Trends Total Orders Index and Fridays GfK Consumer Confidence Index which is expected to remain supported by the robust employment situation in the UK. BoE Governor joins the ECB Chief giving a speech on Financial services in Frankfurt Thursday. The main focus will be on the UK Supreme court's ruling on the legality of PM Johnsons suspension of the Parliament a verdict is expected early this week.

JPY: Eked out a week over week gain to close at 107.56 against the USD, supported by continuous safe haven demand and the BOJ’s refrain from adding further stimulus. The JPY strengthened against all G10s save for the GBP. I continue to maintain a bullish bias on JPY in anticipation of an overall subdued market sentiment in the week ahead. In the Asian docket this we are looking to Japan’s preliminary Markit PMIs released overnight Sunday production remains subdued globally however the sales tax hike may have encouraged some activity to have been brought forward. Bank of Japan Governor Kuroda speaks on Tuesday and BoJ watchers will monitor for hints at future stimulus given a) a planned sales tax hike next month, and b) the fact that the yield on the 10 year government bond breached the lower bound of the central bank’s target range.

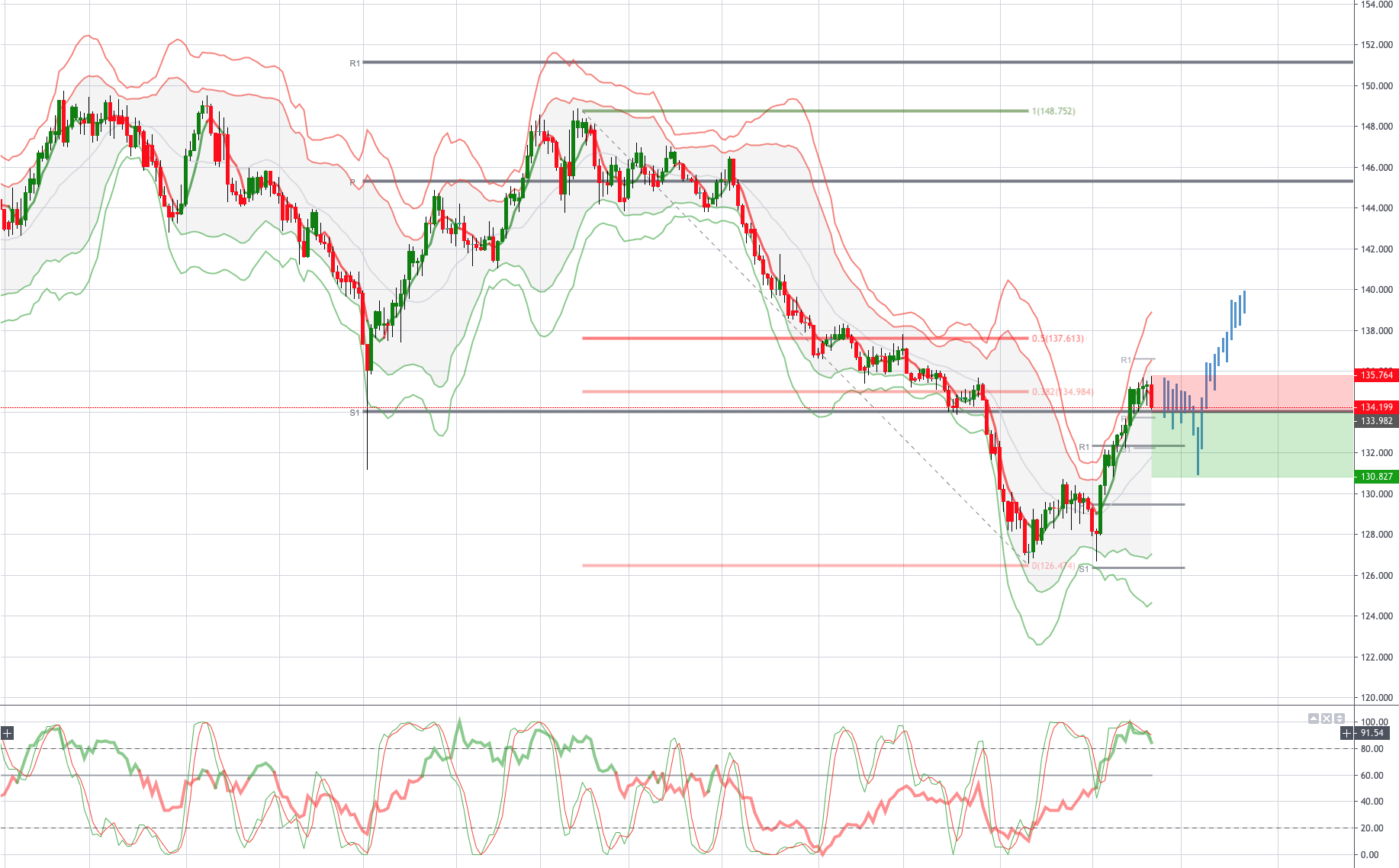

From a technical and trading perspective the GBPJPY appears to be completing the primary wave of a three wave corrective pattern versus the year long downtrend. I am looking for Friday's key reversal at the 38.2% retracement and the prior range lows to act as resistance, initiating a symmetry swing to test bids below 131, as highlighted in the chart. I will be monitoring price action as we test this support zones with the intention to reverse my short exposure for long positions targeting a move to test offers towards 140. A failure at 130 would be a bearish development suggesting a retest of current cycle lows down to 126.50.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!