The FTSE Finish Line - July 07 - 2023

FTSE A New Three Month Low In A Challenging Week For UK Investors

On Friday, the FTSE 100 index in the UK reached a low not seen in over three months, driven by ongoing concerns about high global interest rates. However, there was positive news for Coca-Cola HBC as its shares surged after the bottler raised its profit outlook. Shares of Coca-Cola HBC AG rose by approximately 4% to 2,345p, making it the top percentage gainer in the FTSE 100 index. The company revised its forecast for organic operating profit growth for the fiscal year, raising it to a range of 9% to 12%. This is an improvement from the previous forecast of the top end of the range of -3% to +3%. Coca-Cola HBC attributed the upgrade to a stronger-than-expected finish to the first half of the year and a "very good overall" performance in June. The company stated that its mid-term outlook from 2024 onwards remains unchanged.As of the last close, Coca-Cola HBC's stock was up 14.4% year-to-date.The positive profit outlook for Coca-Cola HBC provided a bright spot amidst the overall downward trend in the FTSE 100 index.However, Coca Cola HBC was pipped to the top spot on the index by the volatile Ocado, as the online grocer after being downgraded by Morgan Stanley yesterday reclaims top spot on the blue chip index gaining 5.24% on the session.

On the negative side of the ledger Relx sits at the bottom of the index as the speciality business services provider over 3.1% on the session additional losses come just days after Barclays issued a ‘neutral' rating on the stock. Severn Trent are hot on Relx heels as the beleaguered water company faces further pressure sliding a further 2.4% as whispers regarding nationalisation continue to weigh.

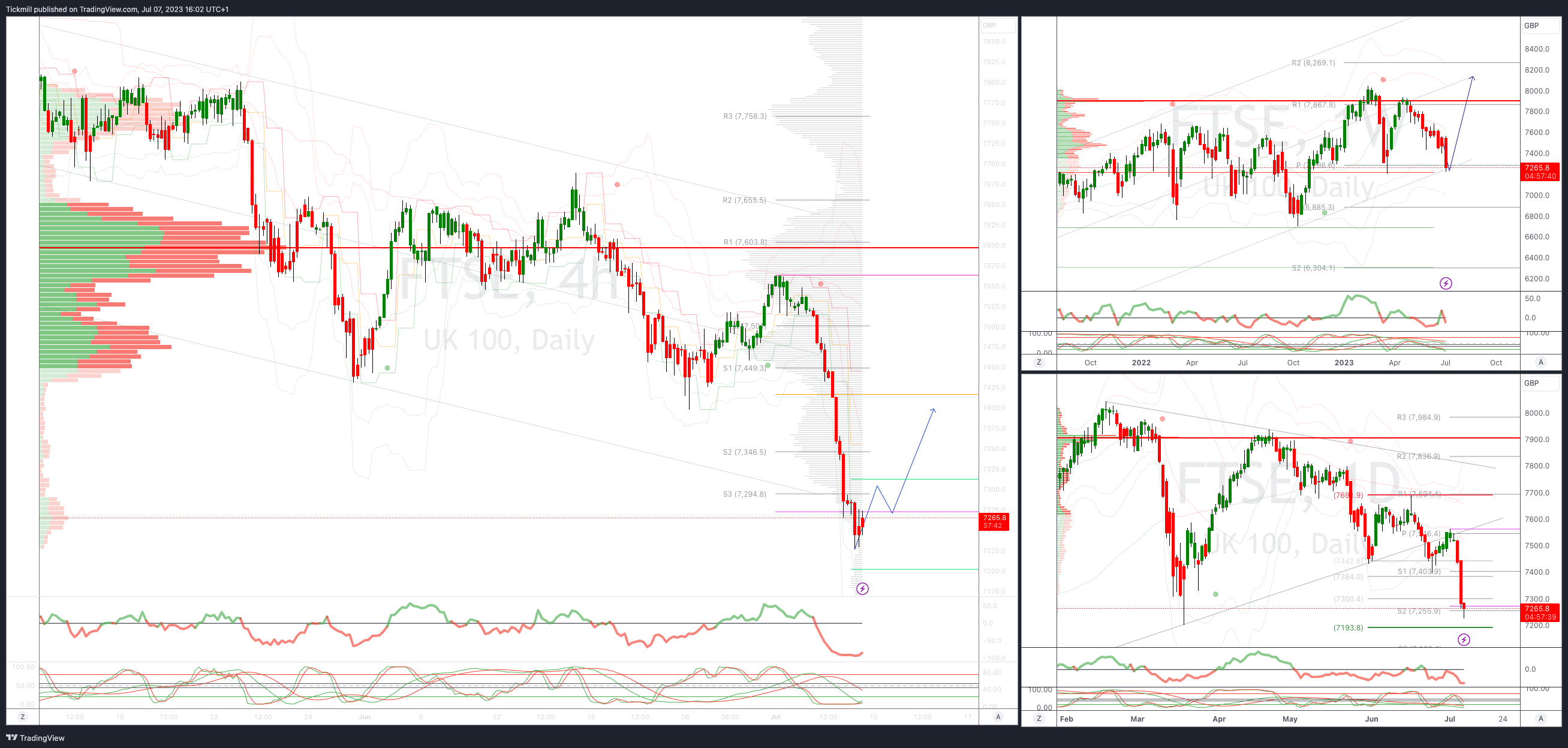

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7193

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!