SP500 LDN TRADING UPDATE 09/05/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5630/40

WEEKLY RANGE RES 5840 SUP 5580

DAILY BULL BEAR ZONE 5630/40

DAILY RANGE RES 5744 SUP 5585

2 SIGMA RES 5966 SUP 5363

5339 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

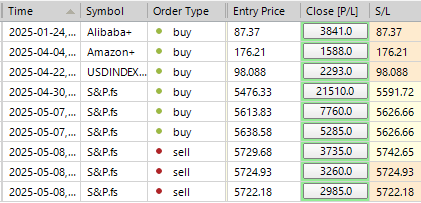

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET WEEKLY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: TRADE TALKS

FICC and Equities | 8 May 2025 |

Market Overview:

- S&P 500: +58bps, closing at 5,663 with MOC of -$3B to SELL.

- NASDAQ (NDX): +98bps, closing at 20,063.

- Russell 2000 (R2K): +194bps, finishing at 2,033.

- Dow Jones (DJIA): +62bps, closing at 41,368.

- Volume: 16.8 billion shares traded across U.S. equity exchanges vs YTD daily average of 16.3 billion.

- VIX: -454bps, closing at 22.48.

- Commodities: Crude +344bps to $60.07; Gold +344bps to $3,310.

- Rates: U.S. 10YR +11bps to 4.39%.

- Currencies: DXY +107bps to 100.67.

- Bitcoin: +408bps to $101,400.

Key Drivers:

U.S. equities rallied sharply after President Trump announced a trade deal with the UK, coupled with remarks suggesting potential tariff reductions on China if talks progress positively. The NY Post reported that the U.S. is considering slashing China tariffs to as low as 50% (down from 145%) as early as next week. The market surge was further fueled by Trump’s statement: "Better go out and buy stocks now." Notably, the last time Trump made a similar remark on April 9, the S&P 500 rallied 952bps.

Sector Performance:

The rally was driven by short squeezes, with strong gains in high-beta cyclicals, non-profitable tech, and meme stocks (all up >3%). Investors remain focused on navigating earnings season, with institutional demand concentrated in macro products. However, pronounced long buying in single stocks was limited.

Trading Desk Activity:

Our floor activity was moderate, scoring a 6/10 on overall activity levels. The desk closed +2% to buy vs a 30-day average of +64bps.

- Institutional Flows: ~$500M net buying, primarily in macro products, tech, and discretionary sectors, partially offset by selling in industrials.

- Hedge Funds: Balanced flows with scattered covers in discretionary and healthcare, offset by small supply in materials and tech.

- IPO Spotlight: Aspen Insurance Holdings (AHL) debuted successfully, priced at $30, opened at $33.25, and closed at $32.50 on 900K shares traded.

Economic Data:

Weekly jobless claims were uneventful, with no significant erosion in "hard data." Jan Hatzius reiterated expectations that elevated hard data could persist for another two months due to forward buying ahead of tariffs.

Derivatives Market:

The U.S./UK trade deal and Trump’s optimistic comments ahead of the U.S.-China trade talks boosted volatility.

- Volatility Trends: Vols initially spiked on the rally but softened as markets reversed from highs. Fixed strike vol continues to struggle, likely due to dealers holding significant downside vol (95%/90%).

- Client Activity: Limited use of call options for hedging shorts; instead, short covering was observed in one-delta products.

- Desk View: While long vol remains attractive, managing carry with short skew is important. Short-dated QQQ downside vol looks particularly appealing.

- Straddle Pricing: The straddle through Monday is priced at ~1.57% as markets anticipate the U.S.-China trade talks this weekend.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!