UK GDP Jumps in June

The British Pound is trading firmly higher today. While some have pointed to England’s semi-final victory in the Euros last night, the more likely driver is the latest set of UK economic data released this morning. UK GDP was seen topping forecasts last month at 0.4%, up sharply from the prior month’s 0% reading, and well above the 0.2% figure the market was looking for. The data is the latest in a recent string of better-than-forecast UK data and is helping bolster bullish sentiment in the Pound as traders scale back BOE rate-cut expectations.

Hawkish BOE Commentary

The data comes hot on the heels of some hawkish BOE commentary this week. Two policymakers from the bank were heard warning against the dangers of cutting rates too early, urging the need to hold policy at current levels for longer. While comments from Haskel and Mann might have been expected, given both are well-known hawks, it was commentary from the BOE’s chief economist Pill that had the most impact. Pill focused on the upside risks still present in services inflation, warning against premature easing.

Easing Expectations In Question

On the back of this commentary and with UK activity jumping last month, traders are now pricing in a lower likelihood of a cut in August. Ultimately, incoming inflation data ahead of that meeting will be the decider. If inflation is seen continuing to fall, particularly if we see a drop in services inflation, this should send easing expectations higher again, weighing on GBP. However, if we see any stickiness or a fresh rise in inflation, easing forecasts are likely to be pushed further out, allowing GBP room to continue higher.

Technical Views

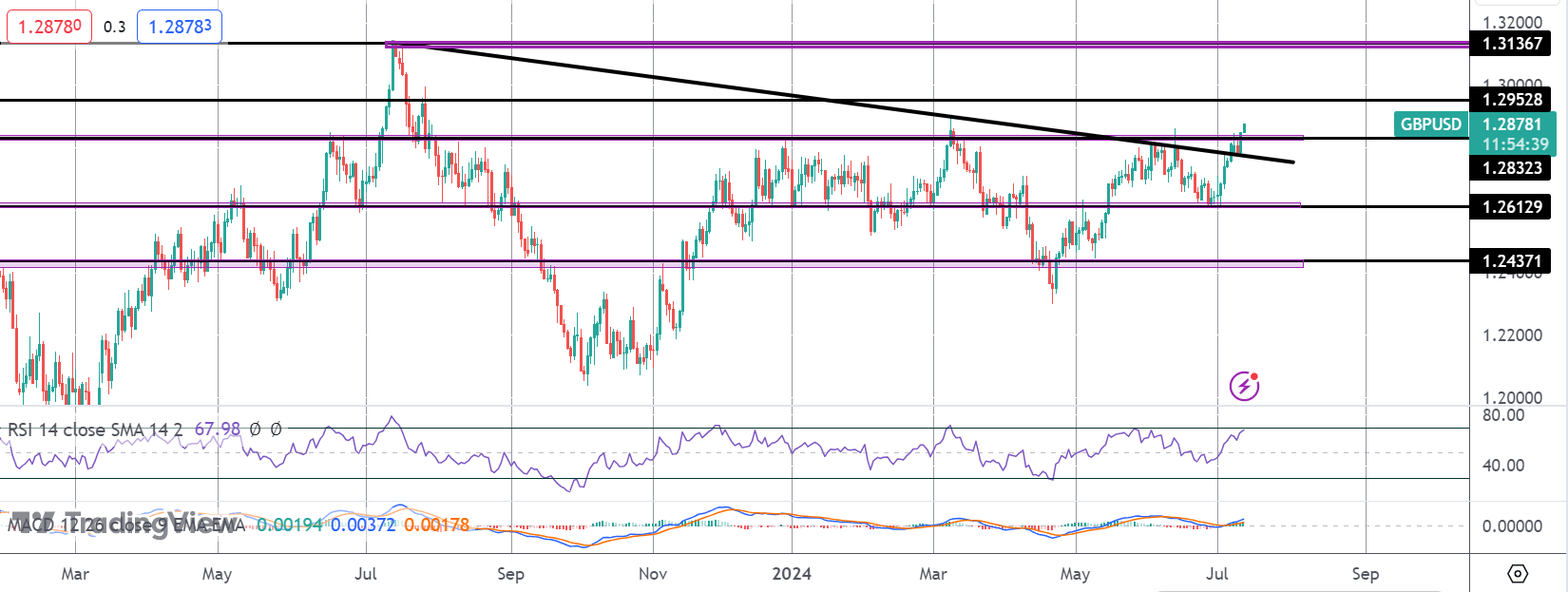

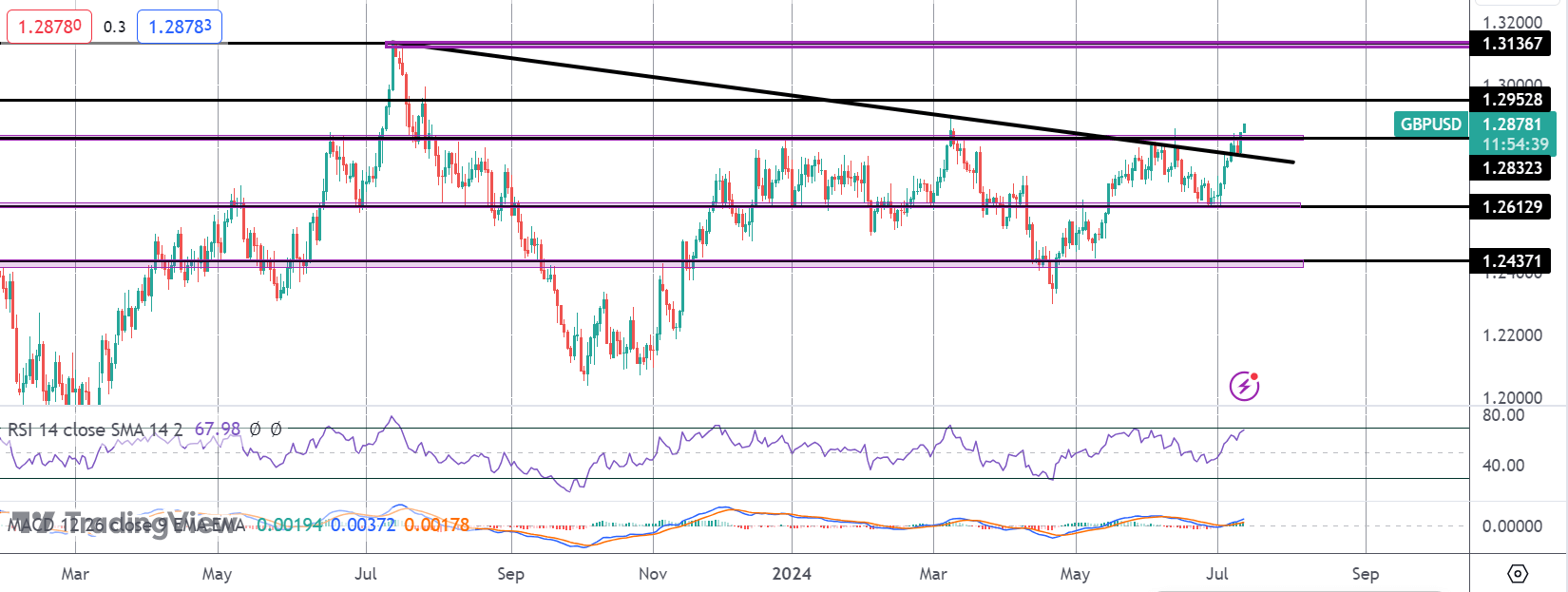

GBPUSD

The rally in GBPUSD has seen the market breaking out above the bear trend line from 2023 highs and above the 1.2832 level. This has been a key resistance level for the pair this year and a break higher here is firmly bullish, putting the focus on a test of 1.2952 next with 1.3136 above as the broader bull objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.