How does the PBOC manipulate Yuan? Real effective RMB exchange rate.

Following the steep decline of the mainland renminbi against the dollar, above the 7 mark, and following the PBOC’s “don’t panic!” statement, the US Treasury was surprisingly prompted to label China as a currency manipulator. The US had been long eschewing this move as China allegedly met only one criterion of rigging its currency. During periods of warming in relations, this accusation would be also ill-timed and risky. However, the fact that China has been accused of controlling the exchange rate raises the question of frequency, intensity of FX interventions, and ultimately of the Yuan’s deviation from its fair value.

Speaking about exchange rate control, the People’s Bank of China daily fixes some USDCNY points called the reference rate, around which the exchange rate can float. The width of the range is 2%. The reference rate is calculated based on the dynamics of the last day, both the renminbi and the currencies of the main trading partners. The calculation formula also includes a “mysterious” countercyclical factor which is in place to counteract the strong skew in sentiment. It’s this factor which often makes the difference between consensus and the actual “Yuan fix”.

Exchange rate movements are also limited by other factors like; tight control over capital flows, quotas on foreign investments and the dominant weight of state-owned banks in the banking sector coordinated with the PBOC, in terms of activity on the FX market.

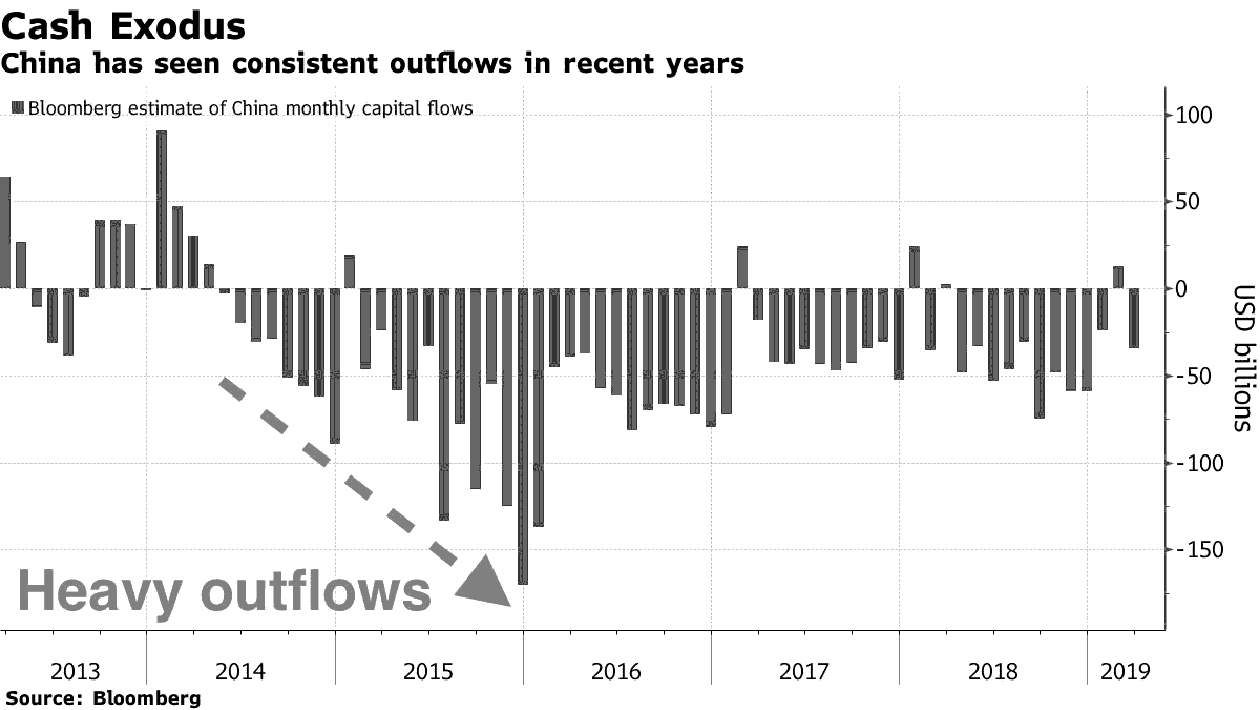

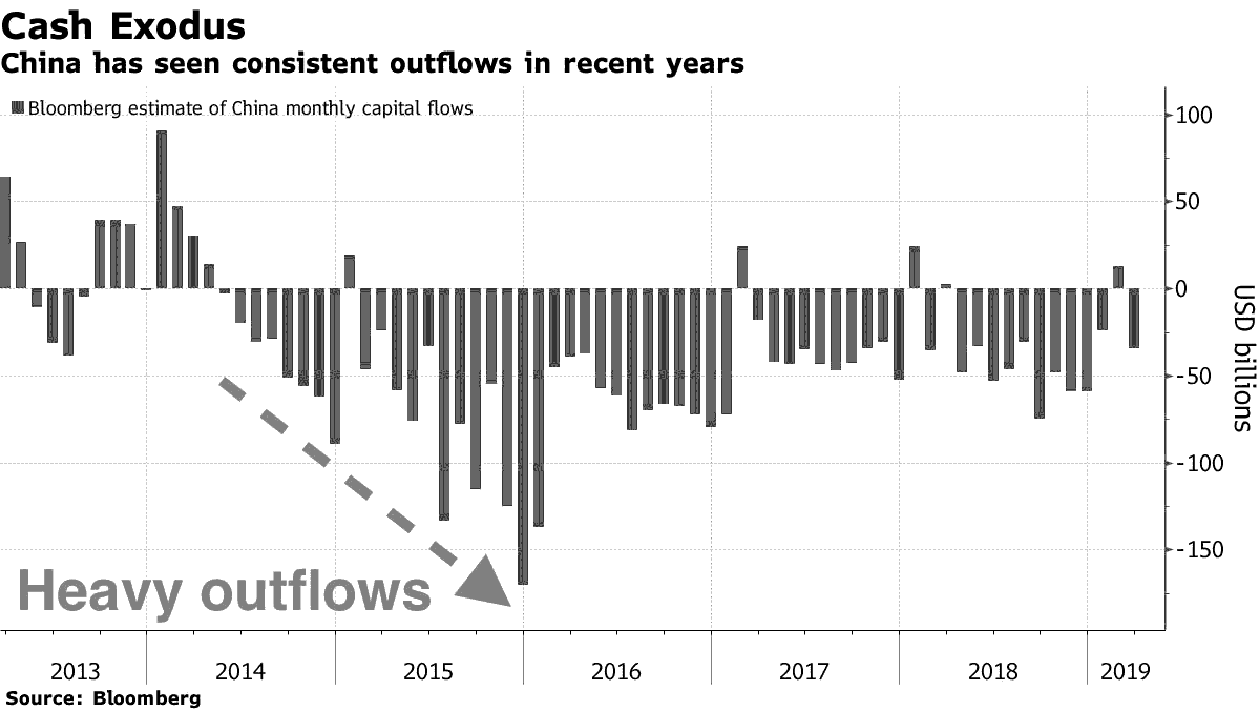

Since the beginning of 2014, the mainland yuan fell 17% against the dollar as a result of two “selling waves” - from 2014 to 2016 and from April 2018 to the present. USDCNY returns clearly correlated with the estimated monthly capital outflows from 2014 to 2016:

But, since the start of the trade war with US in 2018, when Washington introduced the first import tariffs, the offshore yuan has lost about 11%, reaching a record low of 7.1397 this week. At the same time, from the beginning of 2016, capital flight was relatively curbed, although the trend changed to stably negative… Another factor clearly interfered in the depreciation of renminbi.

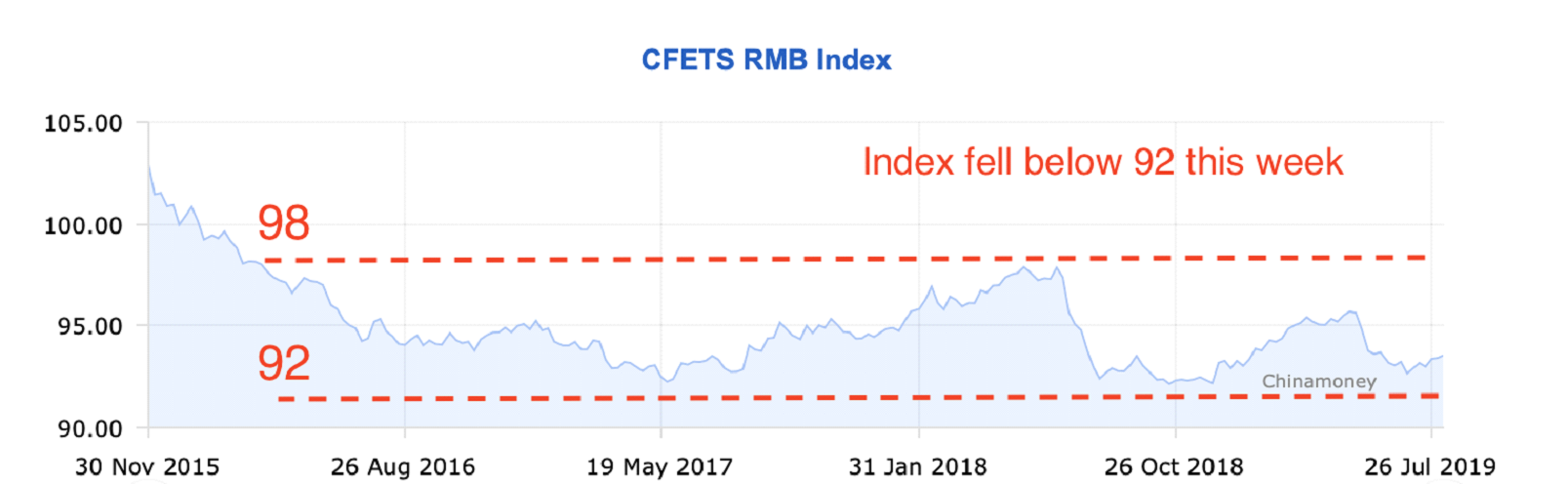

At the end of 2015, China brought to market’s attention a new RMB index in relation to a basket of currencies, weighted by the volume of trade with China (CFETS). According to the authorities, the index more accurately reflected the value of renminbi in terms of trade and investment flows with multiple countries. The basket consisted of 24 currencies, but the dollar has the biggest weight of 22.4% . The index fluctuating in the range of 92-98 was generally perceived as a signal of fair Yuan rate However, this week the index fell below 92, signaling a major loss of Yuan stability, not just against the dollar. Index data is updated once a week.

PBOC rarely intervenes directly in the foreign exchange market and often acts through banks controlled by the state, money markets and foreign exchange reserves. The PBOC also carries out planned sales of RMB-denominated notes in Hong Kong, to limit speculative pressure on the RMB.

Nevertheless, the real effective renminbi (REER) calculated against a basket of major currencies and after adjusting for inflation is now very close to a long-term average. According to BIS estimates for 2018, REER was slightly below the average for the last 4 years. Looking at the longer term, the renminbi REER in June was 4.9% above the 10-year average and 13.4% above the 15-year average.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.