GBP Rally Continues

The British Pound has been on a hot streak recently with GBP enjoying a strong rally against USD over the month so far. GBPUSD is now up almost 9% off the initial November lows and almost 17% off the all-time lows seen in September on the back of the former UK PM’s disastrous mini-budget. The rebound in GBP has largely been driven by the restoration of confidence on the back of Rishi Sunak taking over as PM and Jeremy Hunt delivering a much more balanced and credible budget this month.

Better UK Data

GBP received an additional boost this week from the latest set of UK PMI readings. Both services and manufacturing readings had been expected to fall further from the prior month’s numbers but both came in above expectations. At the same time, US PMIs were seen undershooting forecasts, raising recessionary fears and reinforcing the view that the Fed is likely to opt for a smaller hike next month.

Fed in Focus

The sell off in USD has played a large part in the reversal of fortunes for GBPUSD, reflecting the extent to which USD long positions has built up. With some high-level names having bought GBP at the lows in September, more cautious players are likely joining the move as price heads higher now which should keep the pair supported near term. The big key here will be the next US inflation reading which comes ahead of the December FOMC meeting. If further CPI cooling is seen, a smaller hike in December looks to be far more likely, allowing GBPUSD further room to recover. However, should we see inflation jump back up, this will no doubt keep a larger hike on the table, sending GBPUSD lower near-term.

Technical Views

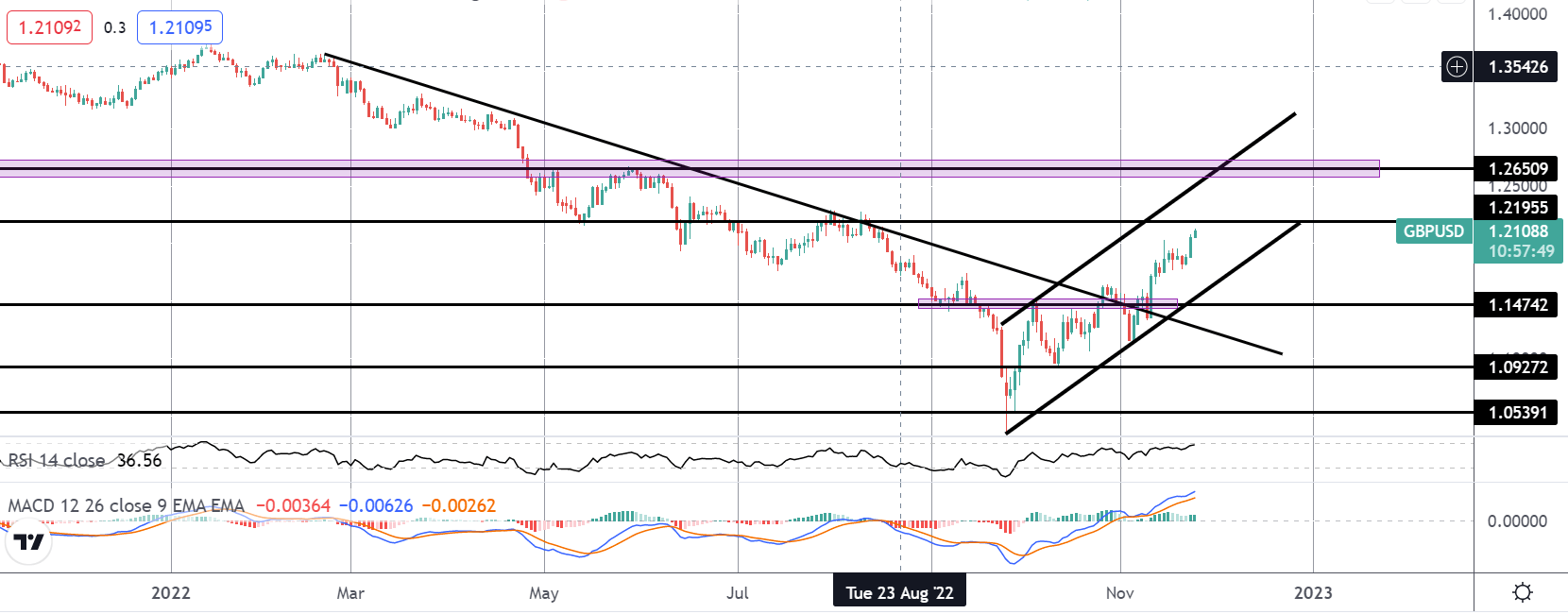

GBPUSD

The rally in GBPUSD off the all-time lows has seen price underpinned by a steep rising trend line. Price has recently broken above the 1.1474 level and is now fast approaching a test of the 1.2195 level. With momentum studies supporting, the focus is on a continuation higher with 1.2650 the next big objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.