US/China Trade Talks

The easing of US/China trade tensions ahead of fresh negotiations this week, as well as a cooling of concerns over US regional banking health, is keeping gold prices capped for now. A weakening of safe-haven demand has seen gold prices oscillating within a tight range over recent days following the last record high print on Friday. Near-term. US/China trade relations remain the key focus point for markets. With US and Chinese officials due to meet this week for the first set of high-level talks in months, there is plenty of two-way risk seen this week.

Two-Way Risks

Should talks progress well and we see positive headlines emerge on the back of these meetings, USD is likely to rally, along side risks sentiment, driving a fresh sell of fin gold prices. However, if talks falter and tensions rise once again (meaning a deal or extension ahead of the Nov 10th deadline looks less likely) this should see gold prices breaking out to fresh highs as risk sentiment recoils.

US Inflation Data on Watch

Beyond those trade talks, traders will also be watching the latest US inflation data due on Friday. If US CPI is seen cooling from recent levels, this should provide a fresh bullish catalyst for gold prices near term. Focus on Fed easing has faded a little in recent weeks, partly due to the lack of data available during the ongoing US govt shutdown and partly because of the return of US/China trade tensions. However, a weaker reading on Friday could put Fed easing expectations back in the spotlight, creating support for a fresh move higher in gold. On the other hand, if CPI is seen topping forecasts, that could muddy the outlook, seeing gold prices come under fresh pressure as USD pushes higher.

Technical Views

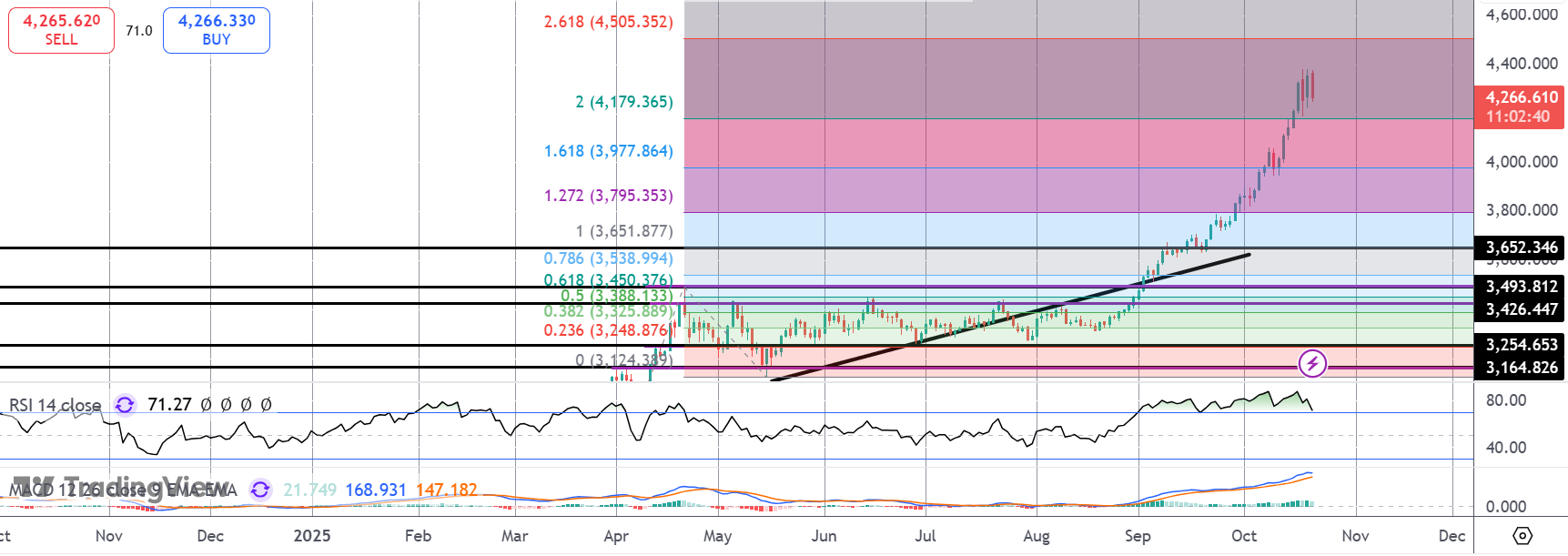

Gold

The rally in gold has stalled for now atop the broken 2% Fib extension level at 4,179.36. While the level holds as support, however, focus is on a continuation higher towards 4,505 next. Should we break below current support 3,977.86 will be the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.