Gold Rebounding Off Lows

Gold prices are on watch ahead of the weekend with the futures market holding the latest test of the 3,254.63 support. Safe-haven demand looks to be rising again here, likely linked to uncertainty around the US Court of International trade ruling that Trump’s reciprocal trade tariffs are illegal and should be blocked, giving the US president 10 days to act. Trump is now appealing the ruling and traders are awaiting further updates.

Implications for Gold Prices

For gold prices the impact of the ruling looks clear. If the ruling is upheld and Trump is forced to abandon reciprocal tariffs, this will be a net-positive for global trade, boosting risk sentiment while dampening safe-haven demand for gold. However, if Trump is successful in his appeal, this should see risk appetite undergoing a fresh deterioration, driving gold higher via increased safe-haven demand. Indeed, such a development might even embolden Trump, spurring him to take a more aggressive stance on trade again. Indeed, as part of the appeal, the White House has signalled the potential to escalate its appeal to the Supreme Court if needs be.

Technical Views

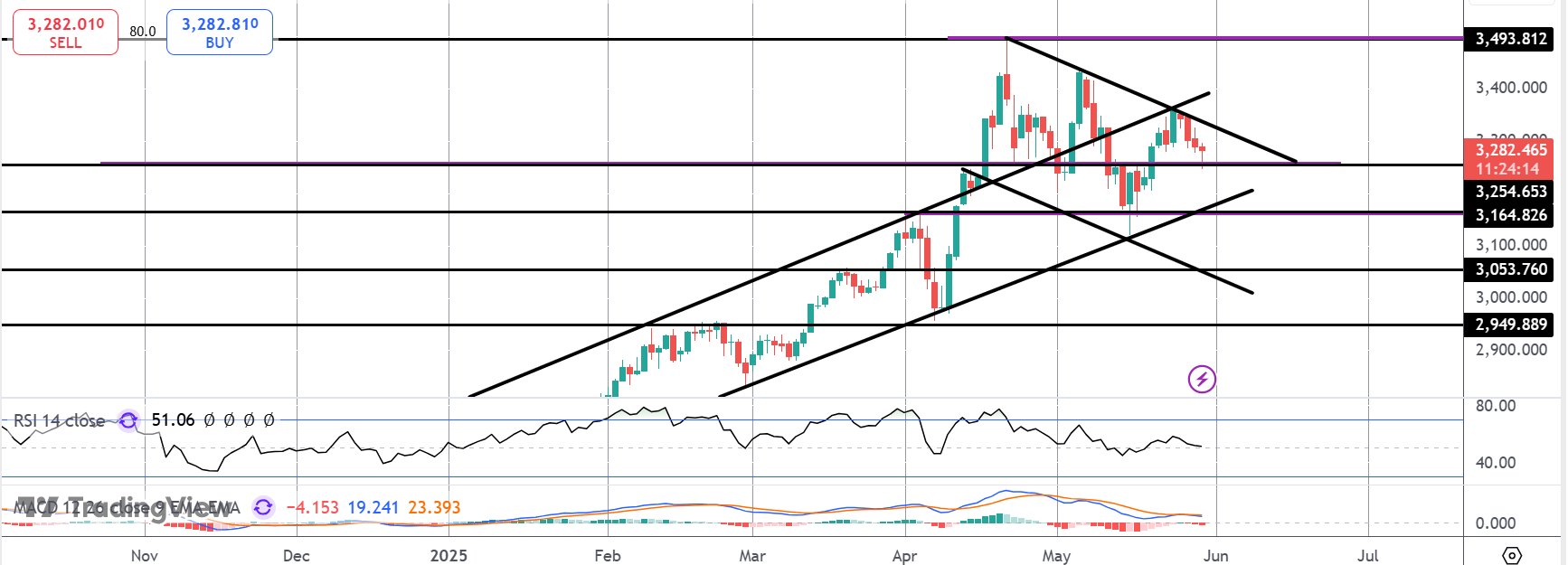

Gold

For now, gold prices remain above the 3,254.63 level but still inside the bear channel from all-time highs. While support holds, focus is on a break higher and a fresh test of the 3,493.81 highs. If we slip lower from here, 3,164.82 will be the next support to watch along with the bull channel lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.