USD Testing Lows

The US Dollar is under heavy selling pressure today on the back of news of a US-brokered ceasefire between Iran and Israel. While there are conflicting reports around the timeline of the ceasefire, with news of continued missile exchanges after the ceasefire was announced, the broad market reaction has been risk-positive and USD-negative for now.

Safe-Haven Flows & Fed

USD had emerged as the preferred safe-haven over last week mainly linked to the view that war in the Middle East would drive oil prices higher, reviving upside inflation risks and putting pressure on the Fed to abandon its easing plan. However, with the ceasefire now in focus and oil prices dropping sharply, traders are scaling back these hawkish Fed expectations, leading USD lower. The market is currently pricing in September as the likely time for the next Fed rate cut. If the ceasefire holds and oil prices fall back deeper, this should keep USD pressured lower near-term as focus returns to softer US data and Fed rate-cut expectations.

Powell in Focus

Looking ahead today, traders will be watching Fed chairman Powell who kicks off his semi-annual testimony at Congress. Recent dovish commentary from Fed’s Waller and Bowman suggest that we could hear a more dovish tone from Powell which, if seen, should see USD trading firmly lower through the middle of the week.

Technical Views

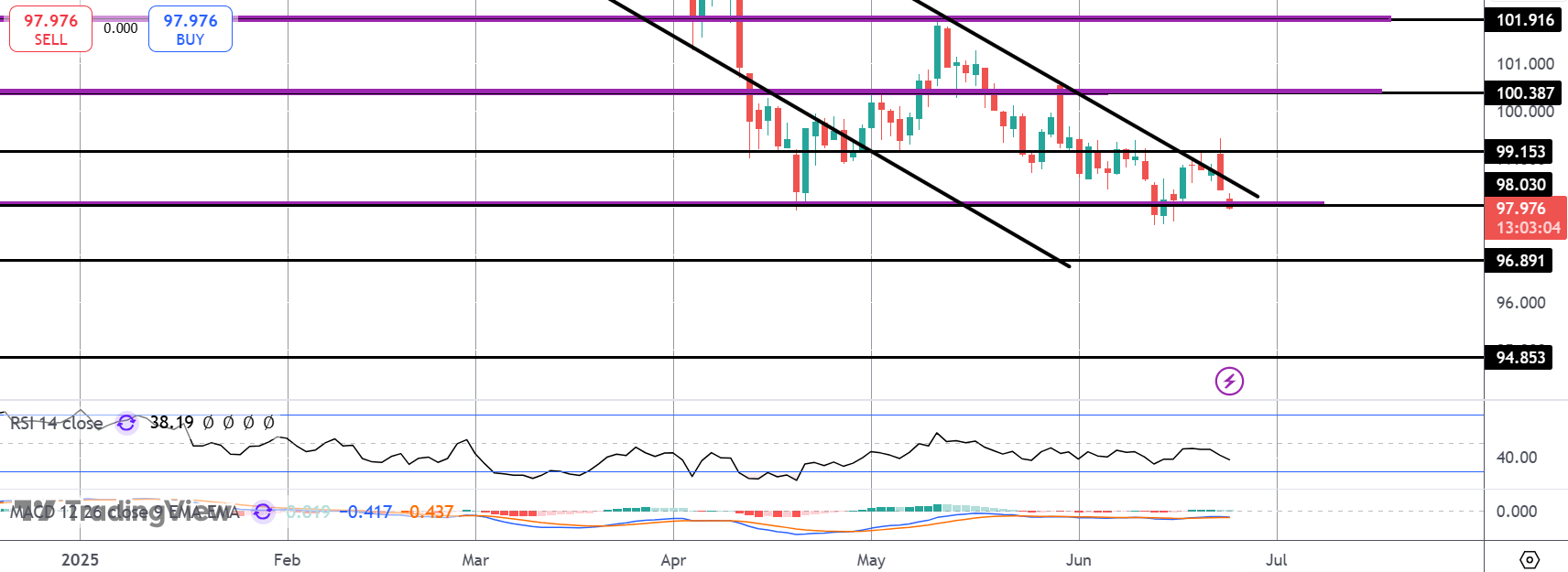

DXY

The index remains under pressure today with price currently testing the 98.03 level support just above YTD lows. With momentum studies bearish, risks are pointed lower with a retest of the 2021 highs around 96.89 seen as the next bear target if we do break down here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.