Dollar Weakens on Trump Tariff Threats Over Greenland

Greenland Pressure Steps Up

The US Dollar is starting the week on a softer footing with the DXY coming under pressure following the latest developments n the US/Greenland story over the weekend. Trump threatened to hit eight European countries with much heavier tariffs unless they co-operate with his initiative to take control of Greenland. The news has been met with widespread criticism from EU and UK leaders and is fuelling a risk off tone to trading on Monday morning with USD equally shunned as investors move into other safe-haven assets. EU leaders are currently weighing up their options for how to respond if Trump does press ahead with tariffs and risks of heavier market implications are elevated near-term with warnings over the weekend of recession risks in the UK should Trump apply tariffs against the UK.

Trump to Speak on Wednesday

For now, traders are waiting to hear what happens next. The economic forum in Davos this week will be closely watched with Trump due to speak on Wednesday followed by EU leader son Thursday. One view is that the EU might follow after China’s approach last year and match Trump’s tariffs one for one, which might ultimately lead to a walk-back from Washington. With a quieter US data schedule this week, incoming news on the US/Greenland story will remain the key driver with USD set to weaken further on any escalation (such as tariffs being announced). Only an announcement that the US is pausing or abandoning its pursuit of Greenland is likely to alter the current outlook near-term.

Technical Views

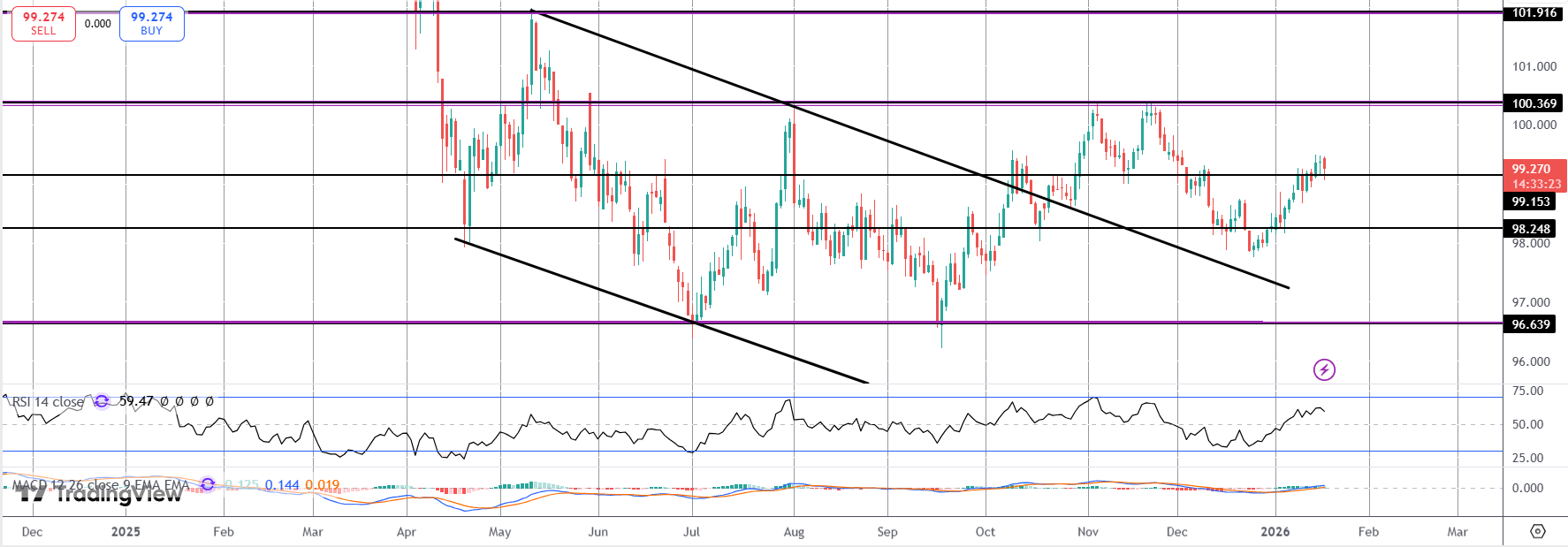

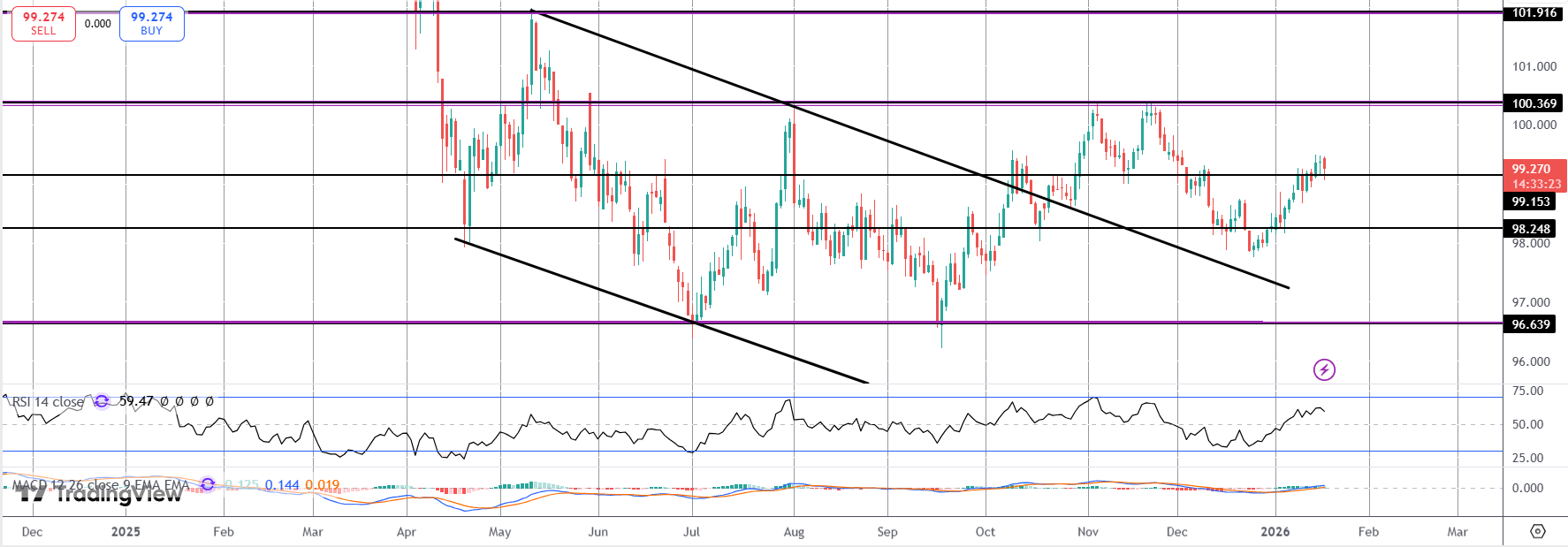

DXY

For now, the index remains above the 99.15 level and while this area holds as support, focus is on a continuation higher with the 100-level the next bull target. If we break below 99.15, however, focus turns to 98.24 as the deeper support level to watch next. Longer-term, the 96.63-100.36 range remains the key frame for price action.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.