Daily Market Outlook, September 29, 2020

The rally in global equities lost some momentum during the Asian trading session. Global coronavirus deaths were reported to have exceeded one million. However, there appeared to be some signs of political progress in plans for a further US fiscal stimulus package, as markets await the first Presidential debate tonight. Meanwhile on the domestic front, it was reported that the EU was ready to work on a joint legal text with the UK on a trade agreement ahead of the start of a new formal round of negotiations today.

Concerns about rising Covid-19 cases, with potential economic implications from more social restrictions, and uncertainty regarding UK-EU trade negotiations will likely take precedence over economic data releases. That said, this morning’s UK August mortgage approvals figures are expected to show a further rise from the previous month, potentially above 80k for the first time since 2007, underlining the current upswing in housing activity. We will also get an update on UK business sentiment from the Lloyds Business Barometer which will be released early Wednesday. In addition, an update of Q2 GDP will also be due tomorrow (at 7am), with a sharp increase expected in the first estimate of the savings ratio. The reasons for such a rise, whether it was voluntary or involuntary, will have a bearing on how much potential consumer pent-up demand there may be.

The controversial Internal Markets Bill continues to wind its way through the UK parliament, with the third reading scheduled in the House of Commons today. BoE Governor Bailey, meanwhile, will make online opening remarks and take part in a Q&A session at the Chief Executives Club at Queen’s University, Belfast. In the Eurozone, the main focus will be on preliminary German CPI data for September. That comes ahead of tomorrow’s Eurozone flash CPI release which we expect to remain negative at -0.2%y/y. The Eurozone economic sentiment index is expected to post another improvement for September, supported by stronger consumer, industrial and services confidence, but it will remain below pre-Covid levels.

Outside Europe, there are a number of Fed speakers. Data wise, we predict the Conference Board measure of US consumer confidence to rise to 89.0 from 84.8. That would be the first increase in three months. China will also release PMIs early tomorrow morning. The key focus, however, will be tonight’s first Presidential debate scheduled for 9pm (ET) / 2am (BST).

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1600 (512M), 1.1650 (350M), 1.1700 (263M)

- USDJPY: 105.00 (2.6BLN), 105.10 (375M), 105.30-35 (1.5BLN), 106.15 (350M)

- EURJPY: 122.00 (1.1BLN), 122.60 (1.5BLN), 123.20 (1.8BLN), 124.00 (1.8BLN)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16

Flow reports Downside bids limited through the 1.1620 area opening the downside through to the 1.1480-1.1500 level in the short term, limited congestion around the 1.1680-1.1700 level with weak stops likely on a break through the 1.1720 area and weakness then running through to the 1.1800 likely to be stronger

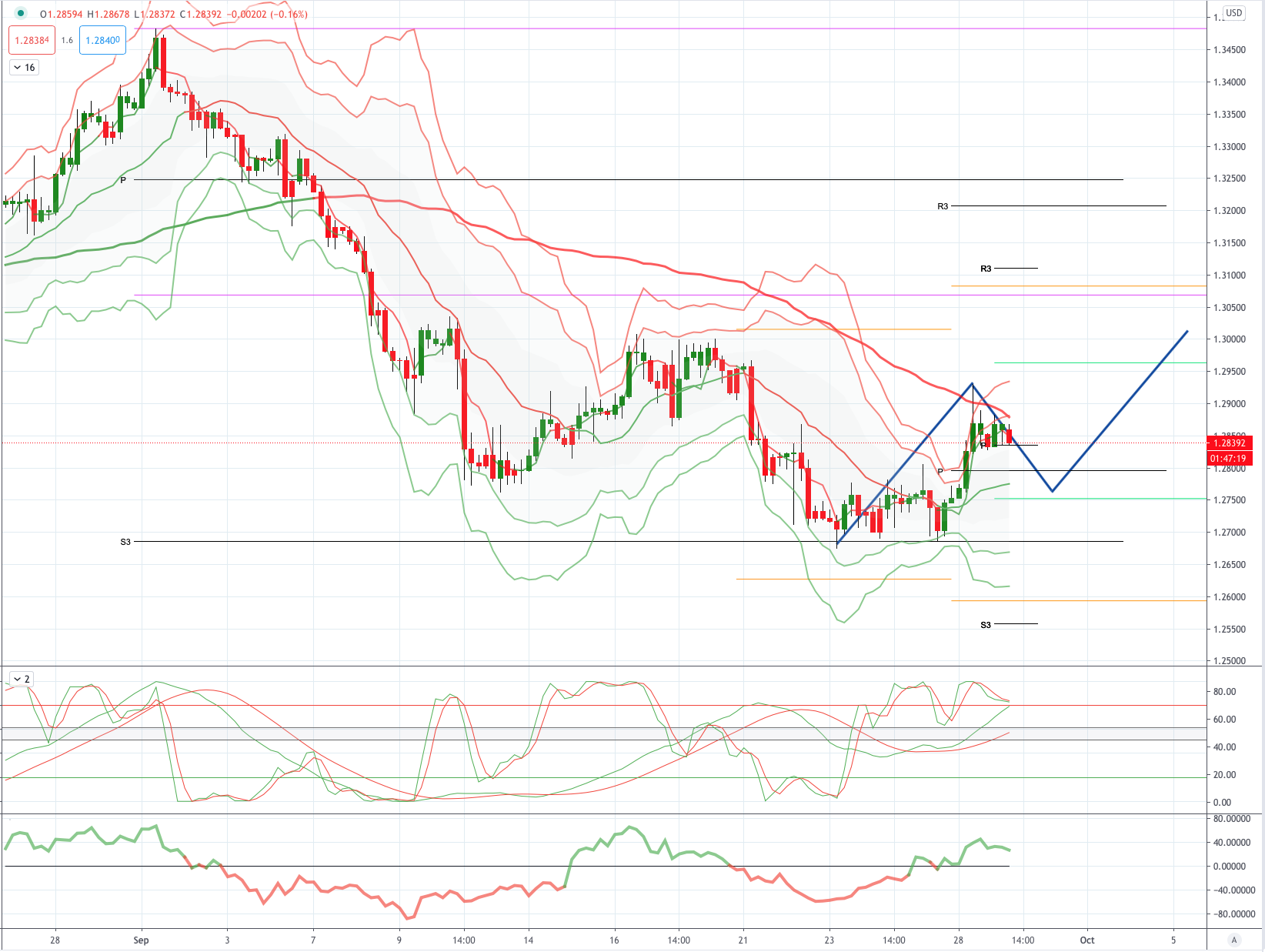

GBPUSD Bias: Bearish below 1.2850 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend

Flow reports suggest topside offers light through to the 1.2900 level with offers congested through to the 1.2930 area before lighter offers begin to appear into the sentimental 1.2950 area stronger offers are then likely on any approach to the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

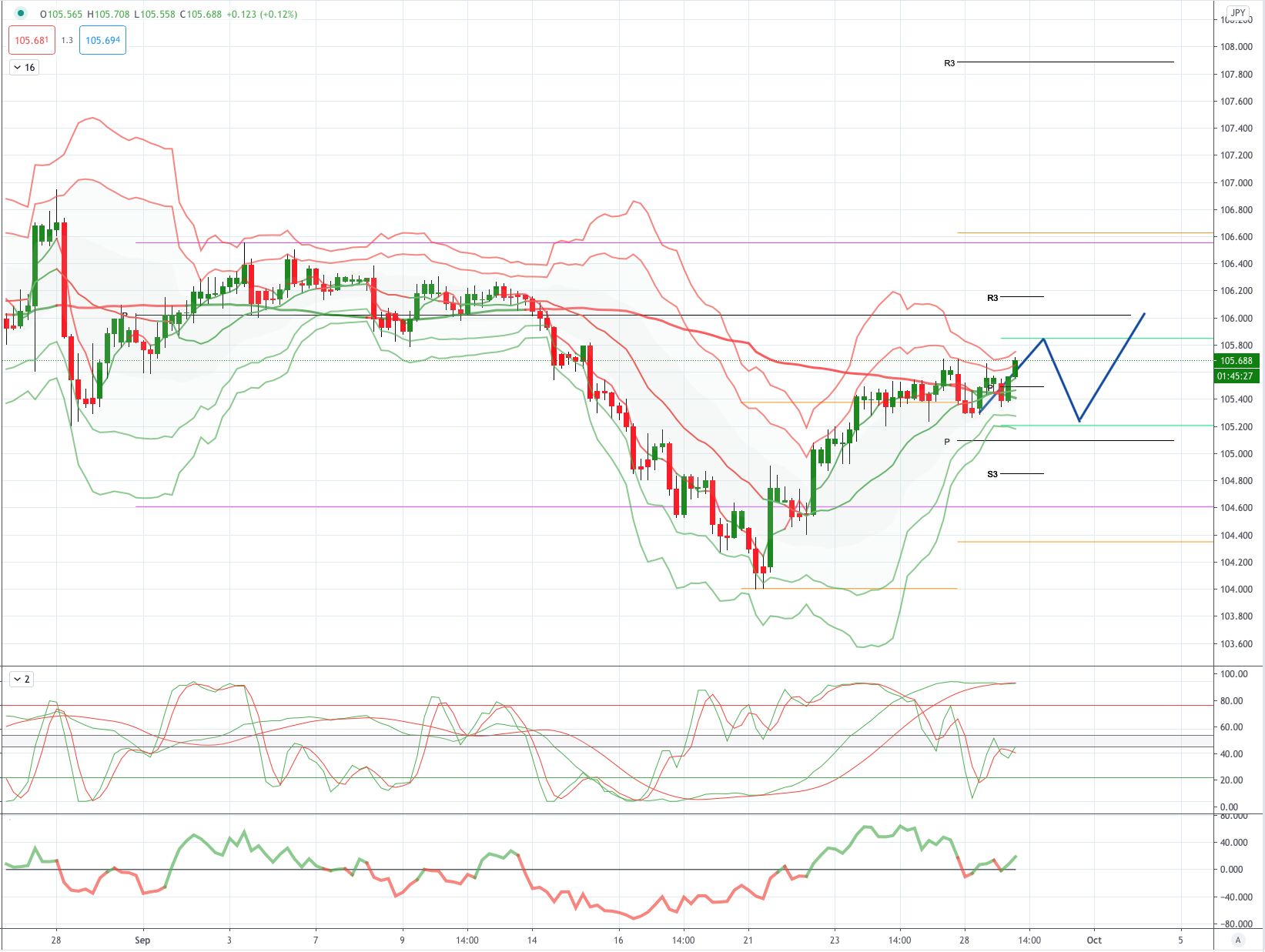

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. NOTE Massive 3-billion USD/JPY between 104.90-105.10 expire Thursday NY cut UPDATE lok for test of 105.80 to see profit taking on first test, however, as 105.10 supports look for a test of 106

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

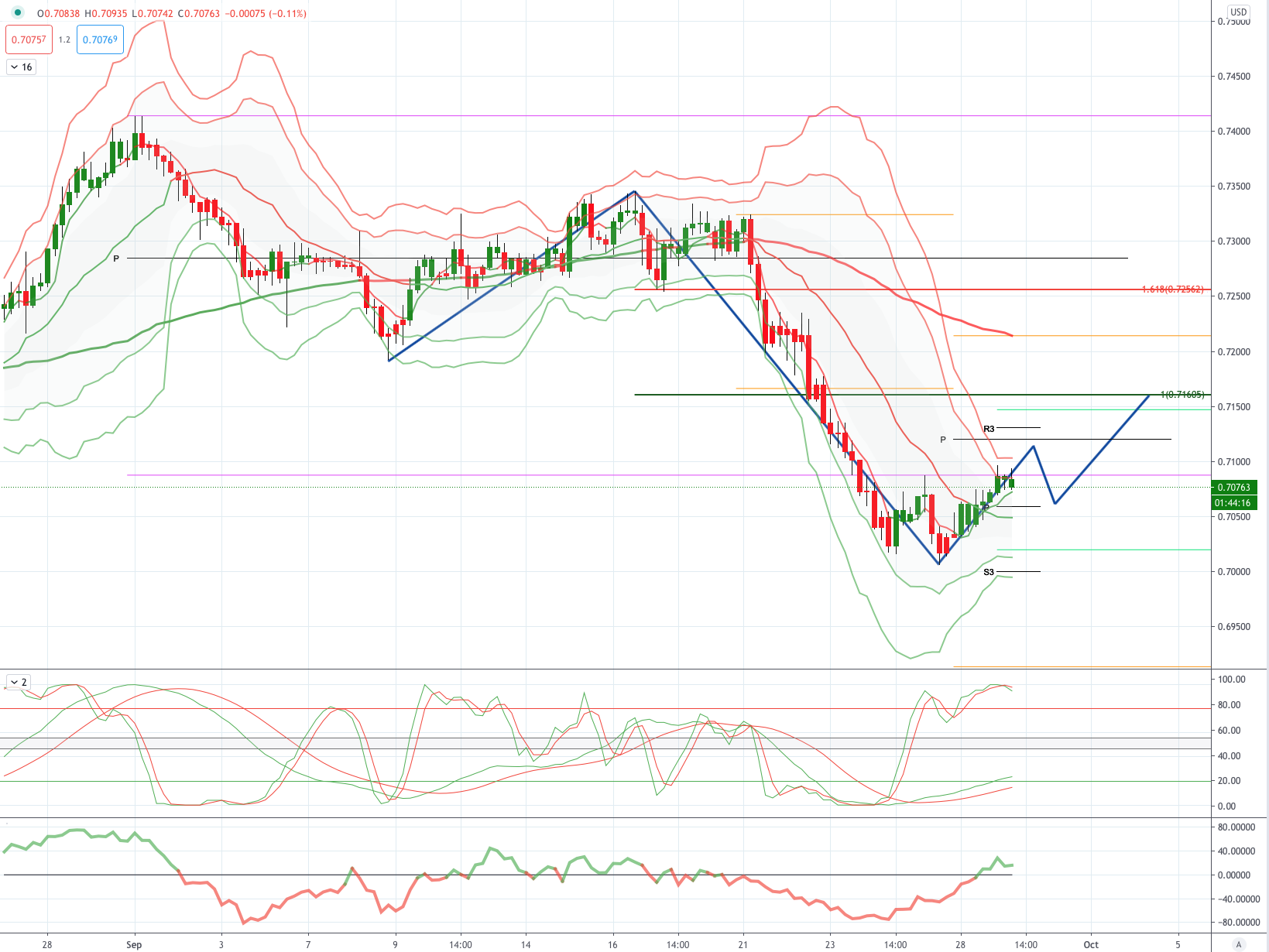

AUDUSD Bias: Bullish above .7150 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside offers light through the 70 cents handle with stronger offers starting to build for any move through to the 0.7100 with weak stops on a push through the 0.7120 area and opening to the 0.7160 level before sufficient offers appear to slow any further rise however, strong offers through to the 72 cents level are likely to stymie any further movement.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!