Daily Market Outlook, August 19, 2020

Asian equity market has had mixed performance overnight, with Chinese indices modestly lower. Deteriorating US-Sino relations remain a key theme. President Trump said that he delayed the trade review due last Saturday because he didn’t want to talk to China and called her handling of Covid-19 as “unthinkable”. Chinese officials called recent US moves against Huawei as “nothing short of bullying.” Former VP Joe Biden was formerly confirmed as the Democratic candidate for November’s presidential election yesterday. The Democratic leader of the lower chamber of Congress said a compromise was possible to reach a deal on a new US fiscal stimulus package.

Data released this morning showed a larger-than-expected rise in UK July annual CPI inflation to 1.0%% from 0.6% in June. However, that still leaves inflation well below the 2.0% target and is unlikely to change the outlook for monetary policy. Data for August is expected to show a sharp drop as the impact of Chancellor Sunak’s VAT cut for the hospitality sector and the ‘eat out to help out’ scheme are felt.

Today’s economic data calendar is again very sparse. The July Eurozone CPI release is a final estimate, which is expected to be unrevised from the initial reading. That showed a rise in both overall and ‘core’ annual inflation. However, as both are still well below the European Central bank’s target, that inflation should be ‘close to but below 2.0%’, the ECB will remain focused on using monetary policy stimulus to support the rebound in the economy.

In the UK, the official measure of house price inflation is likely to show subdued growth in June during the initial stages of the removal of lockdown restrictions. However, anecdotal reports point to a pickup in the housing market in the wake of Chancellor Sunak’s temporary reduction in stamp duty. That is likely to have a knock on effect on house prices but today’s data is too early to be impacted by that.

The US Federal Reserve will release the minutes of its latest monetary policy meeting tonight. As expected, policy was left unchanged but Fed Chair Powell reiterated that they stood ready to offer more support to the economy if necessary. Markets may in particular look for two things. First, discussions around the Fed’s ongoing policy review, which Powell said is now almost complete. Some analysts have speculated that the Fed may in future allow for a period of above target inflation to offset previous undershoots. Second, any further indication that the Fed intends to change its ‘forward guidance’ in the near future to make it clearer what economic developments would generate a policy change.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1650 (276M), 1.1755 (1.38BLN), 1.1900 (1.7BLN)

- USDJPY:105.00 (762M), 105.25-30 (800M), 105.80 (480M) 106.00 (375M), 106.50-65 (940M), 106.75 (280M), 106.90-00 (1.1BLN), 107.25 (420M), 108.00 (500M)

Technical & Trade Views

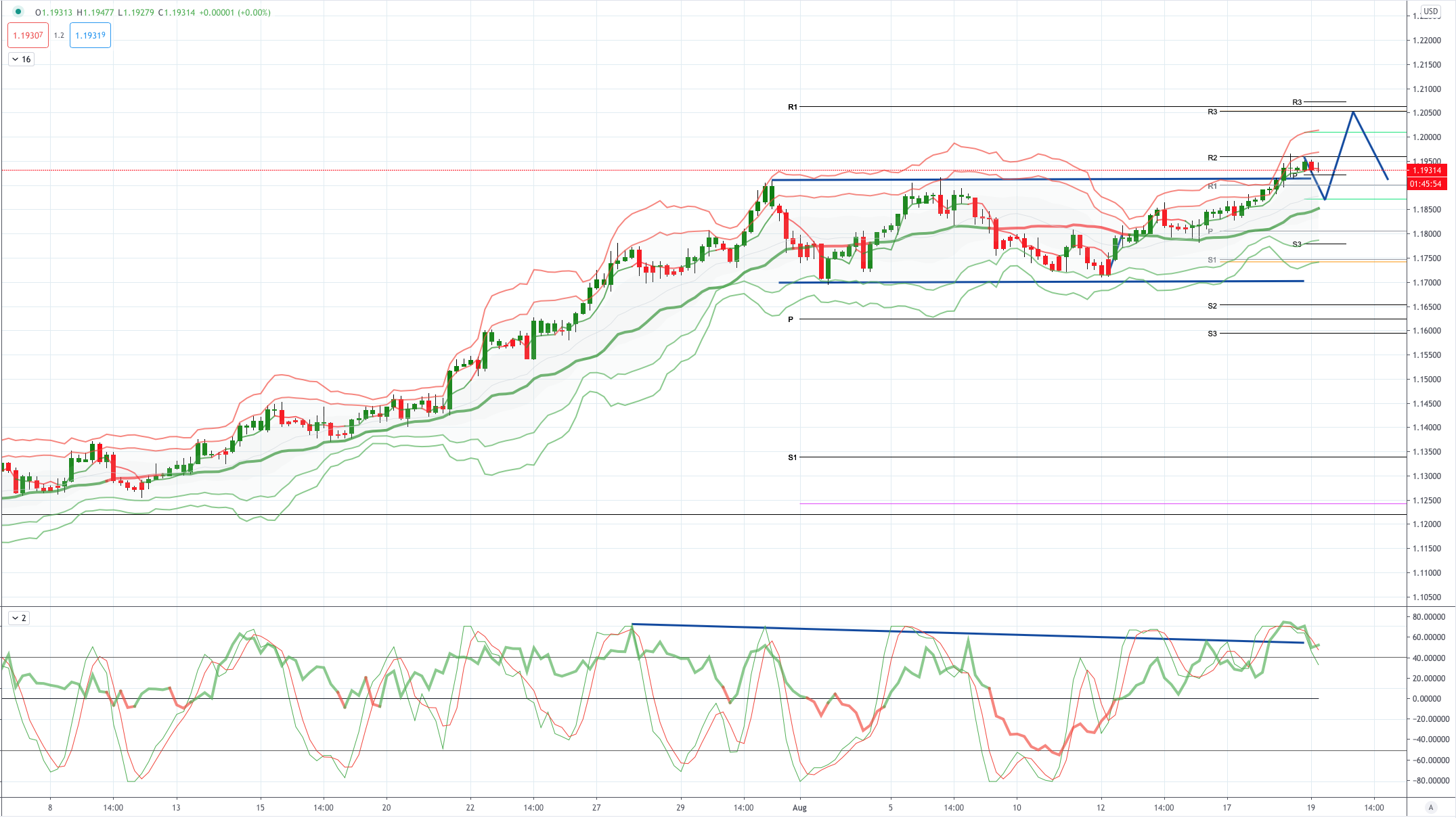

EURUSD Bias: Bullish above 1.17 targeting 1.20

EURUSD From a technical and trading perspective, as.18 continues to hold as such stops above 1.19 are starting to look vulnerable en route to a 1.20 battle as discussed in last week's live session. Only a closing breach of 1.17 would concern the bullish bias UPDATE first foray towards 1.20 meets some supply and potential option barrier protection. As 1.1850 supports then bulls will continue to try and erode the 1.20 offers and stops

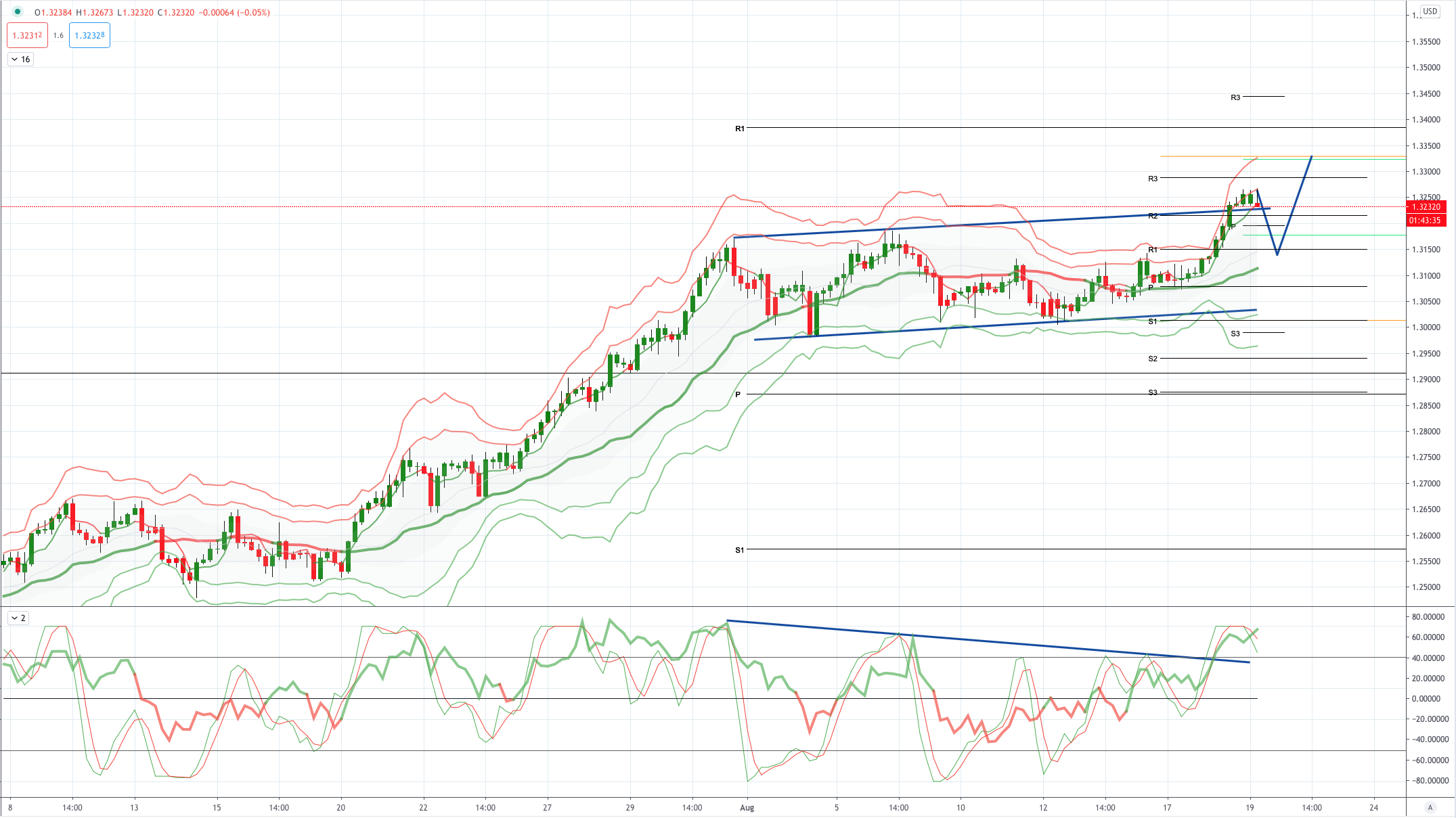

GBPUSD Bias: Bullish above 1.30 targeting 1.3250

GBPUSD From a technical and trading perspective, as 1.30 is defended stops above 1.32 look vulnerable for a test and breach enroute to a 1.33 test. Only a closing breach of 1.30 would concern the bullish bias UPDATE target achieved, potential for profit taking pullback to 1.3150 before another base attempt targeting 1.3330

USDJPY Bias: Bullish above 105.50 targeting 107.50 Bearish below 105.30

USDJPY From a technical and trading perspective, anticipated test of the equality objective at 104.50 attract big bids, printing a key reversal pattern on Friday, as discussed in today’s Chart Hit, as 105.50 acts as a support look for a test of the equality objective to 107.50. UPDATE as 106.40 supports look for a grind higher to test symmetry swing resistance sighted at 108 UPDATE retesting support at 105.50 failure to find sufficient bids here will expose 104.18 again

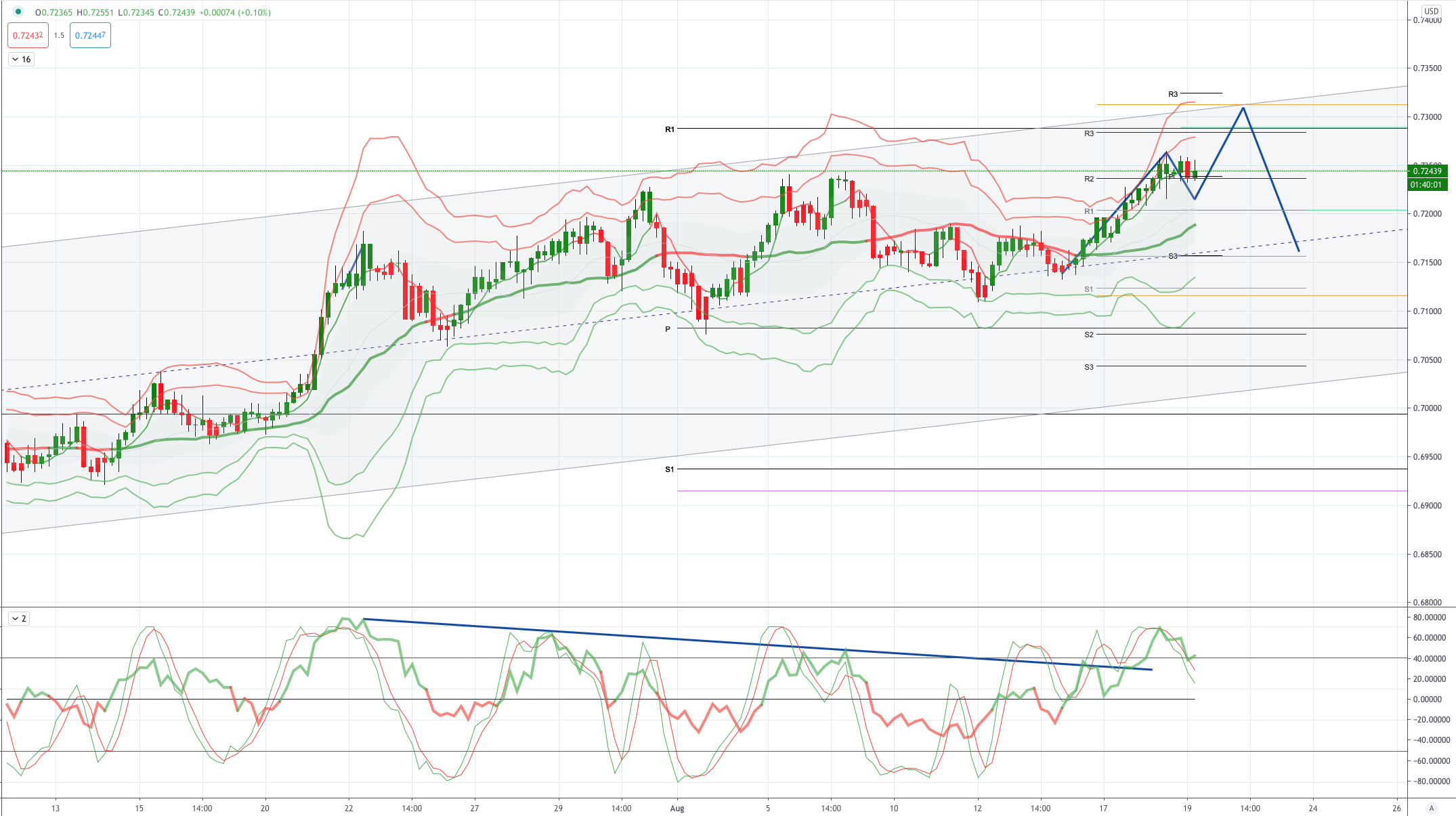

AUDUSD Bias: Bullish above .7200 targeting .7300

AUDUSD From a technical and trading perspective, test of stops and offers above .7220 has delivered the anticipated corrective phase, as .7170/90 now acts as resistance look for a test .6950 as ascending support. UPDATE potential double top in place to deliver the test of ascending trend channel support now at .7000 UPDATE price retesting supply to .7220 through here opens a test of ending diagonal resistance at .7300 as discussed in yesterday’s Chart Hit

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!