Crude Testing Major Support Level

Crude Selling Deepens

Crude prices remain under heavy selling pressure on Tuesday with the futures market now within touching distance of the YTD lows. Crude futures have fallen almost 8% from the December highs and almost 25% from the YTD highs. The move lower comes amidst growing speculation that a Russia-Ukraine peace deal is getting closer, exacerbating the oversupply concerns which had weighed on sentiment in recent months. Growing pressure on Russia from European leaders is seen as an important development with the EU freezing more than 210 billion EUR of Russian assets indefinitely. US led talks are ongoing with Trump this week signalling that a peace deal is closer than ever as negotiations with Putin and Zelensky continue. If agreed, a peace deal would see sanctions on Russia lifted and the return of Russian crude supply to the wider Market. Given the backdrop of oversupply concerns already, this is a firmly bearish prospect for crude prices.

US Data & The Fed

The sell off in crude comes despite a weaker USD recently. The greenback has fallen on the back of the recent Fed rate cut and balanced prospects of a further cut in Q1 next year. As such, the movement in crude suggests that oversupply concerns remain the bigger factor to watch. With that in mind, traders will be looking ahead to the latest US jobs data today. If further weakness is seen in the NFP, this should keep USD demand expectations anchored lower, putting further pressure on crude near-term. Focus will then turn to the latest EIA inventories data due tomorrow which could fuel further selling if a surplus is seen, underscoring the low demand environment.

Technical Views

Crude

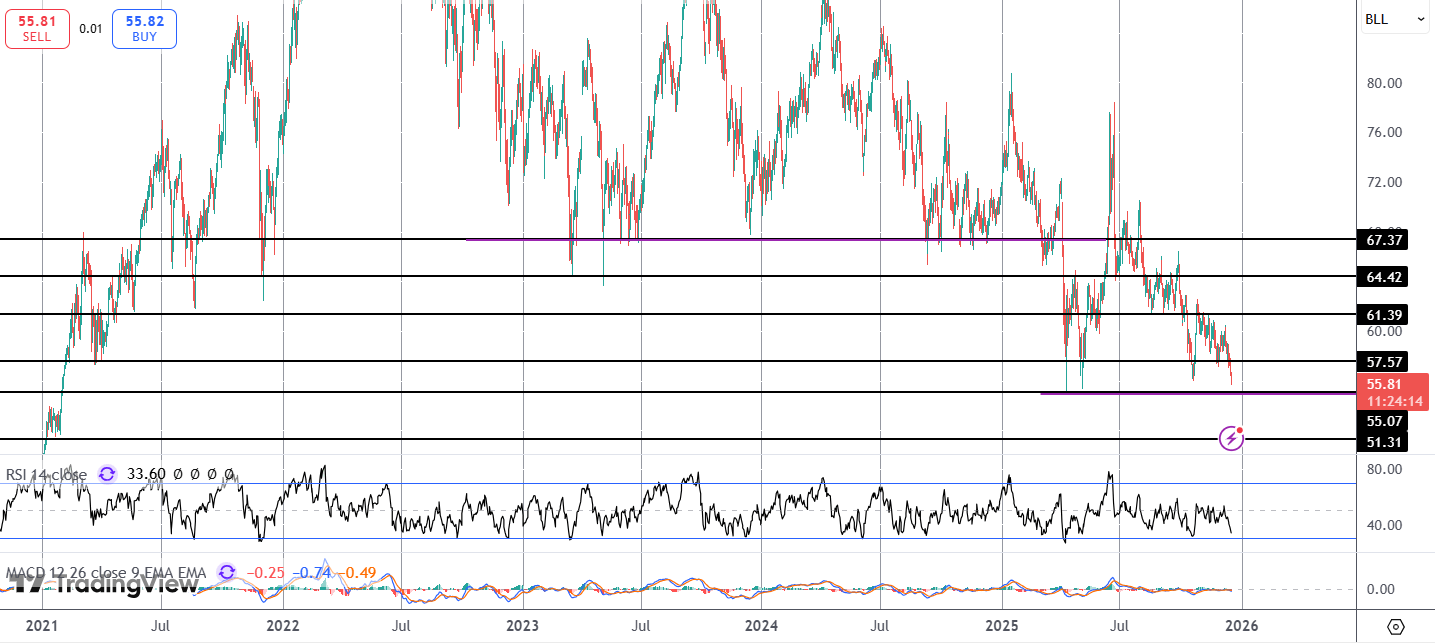

Taking a zoomed-out view on crude, we can see that price is now testing a key support zone at the 55.07 level which has remained the 2025 low for now. If broken, focus turns to a test of deeper support at the 51.31 level next, turning the picture heavily bearish near-term. Only a recovery above 57.57 will alleviate immediate bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.