Copper Breaking Out

Copper prices are pushing higher again today following a correction lower over the last two days as the futures market pulled back from fresh all-time highs. The market has been pushing higher since late November driven by growing concerns over tightening supply as well as fluctuations in economic expectations in the US and China. This week S&P put out a note warning that copper prices look set to push much higher as demand soars, fuelled by increasing requirements in both the AI sector and defence.

Copper Shortage Warning

S&P signalled that global copper demand is likely to rise by as much as 50% over the next decade while warning that a shortage in copper would pose key risks to global growth. These warnings of the threat from a potential copper shortage come on the back of comments from Australian miner BHP this week warning of a supply deficit looming as soon as 2030 as a result of weak production levels and rising demand.

Better China Data

Data out of China this week showing that inflation hit its highest level in 3 years last month, is also feeding into better demand for copper. Signs that weakness in the Chinese economy is repairing itself bodes well for demand and prices are likely to remain supported in response to any further bullish data out of China.

US Jobs Data

In the US, the latest labour market data due this afternoon will be the key focus. If jobs growth is seen positive, this should add further support for copper (reinforcing demand expectations), despite the offsetting impact of a stronger USD.

Technical Views

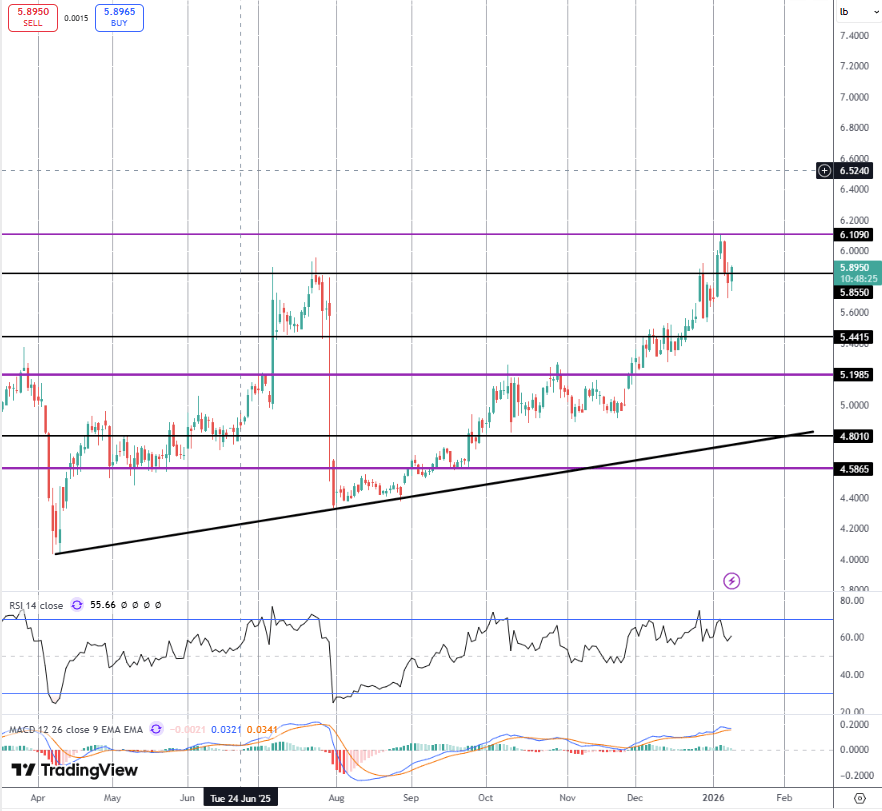

Copper

The rally in copper has stalled for now into highs of 6.1090 with price briefly reversing back under the 2025 highs around 5.8550. Momentum studies remain bullish and with the market now turning higher again, focus is on a fresh breakout and a continuation north into fresh highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.