UK CPI Jumps

We’re seeing heightened volatility in GBP today following the release of the latest UK economic data this morning. UK inflation was seen jumping above forecasts last month with headline annualised CPI hitting 2.3% from 1.7%, a stark increase and above the 2.2% reading the market was looking for. Similarly, core inflation was seen rising to 3.3% from 3.2% prior, above the 3.1% level the market was looking for.

Inflation Details

Looking at the breakdown of the data, housing and housing services saw the biggest upward contributions, rising 5.5% against 3.8% at the prior reading. Restaurants and hotels also saw a jump in prices. Notably, services inflation, which is a measure closely watched by the BOE, was seen rising again to 5% from 4.9%.

BOE Easing Expectations

With consumer prices now back at their highest level since April, the prospect of a further BOE cut in December looks much weaker. Expectations of a further cut had started to creep higher in response to weaker labour market and growth data recently. However, with prices jumping to such a large extent, the BOE will certainly want to see whether this was a one-off spike or the start of a trending move higher.

USD Strength Remains Key

While GBPUSD was higher initially, the broader macro picture of USD strength has seen those gains tempered for now. With USD pushing higher again today, the pair is vulnerable to a fresh break lower if we see DXY pushing back to highs. As such, will be key to watch incoming Fed speak later in the day which is likely to shape USD action.

Technical Views

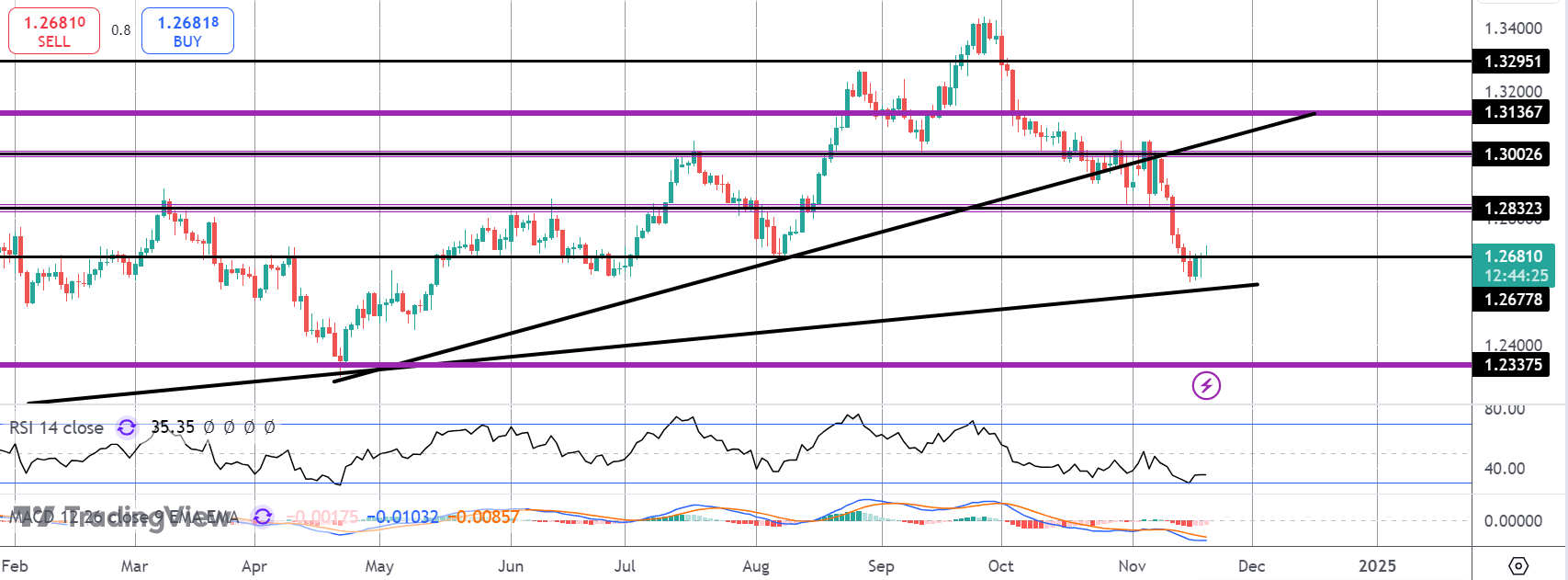

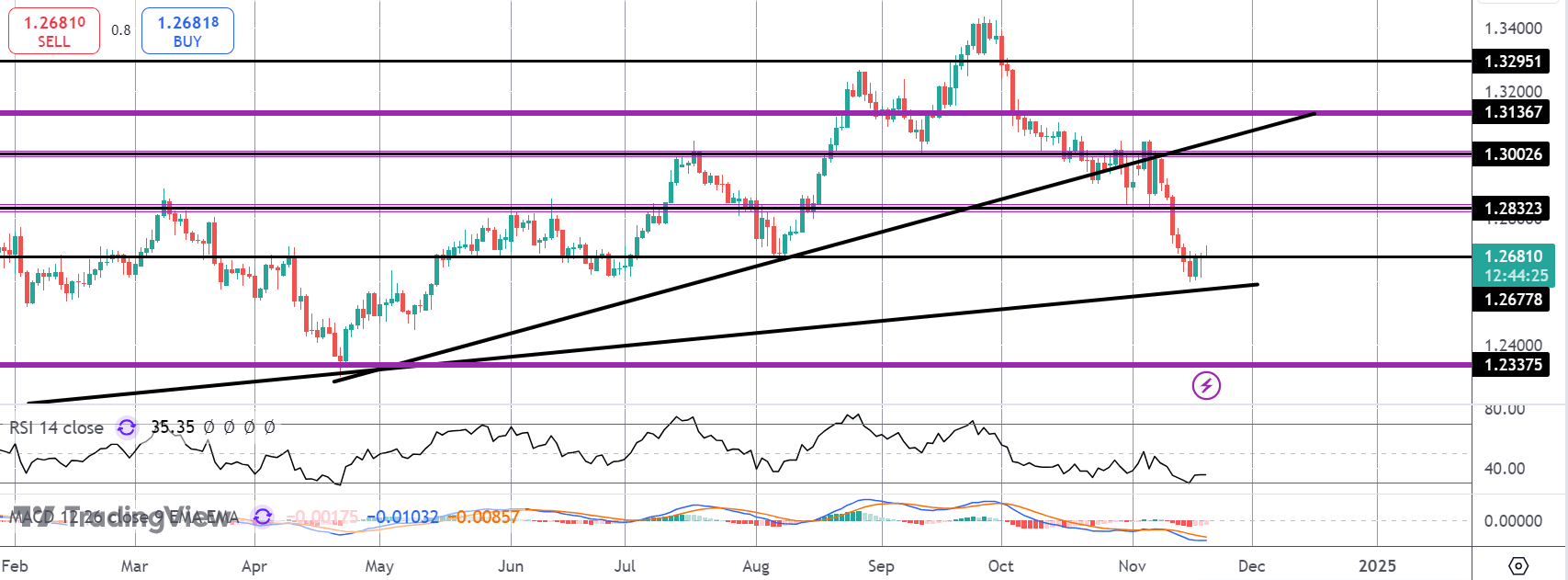

GBPUSD

For now, price is hovering around the 1.2677 level support following heavy selling over the month so far. Given the decline, risks remain skewed to the downside with 1.2337 the deeper bear target if we break though the trend line support just below market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.