Soaring Institutional Demand

Bitcoin prices are on watch today with the futures market testing the key $108k-level resistance, just below the all-time highs. Institutional demand has surged higher in recent weeks with BTC ETFs recording a record $3.3 billion over the last 10-days. Indeed, industry data reflects a massive amount of short-liquidations over the course of the latest push higher this week with growing long interest suggesting a forthcoming breakout.

Risk Sentiment & BTC

The rally in Bitcoin suggests a decoupling from the broader risk complex where stocks have softened over the last two days amidst rising geopolitical uncertainty. Bitcoin had previously been bolstered by optimism around US/China trade talks. However, where that optimism has faded this week, capping the rally in other risk assets, BTC has continue to push higher.

Crypto Bill in US Congress

Developments in the crypto space are turning increasingly bullish for Bitcoin and traders are now looking ahead with excitement to the crypto bill due to be discussed in US Congress tomorrow. If the debate goes well BTC looks poised to breakout this week. Indeed, leading US IB JP Morgan this week revised higher its year end BTC forecast to $150k, echoing a similar forecast issued last week from Standard Chartered.

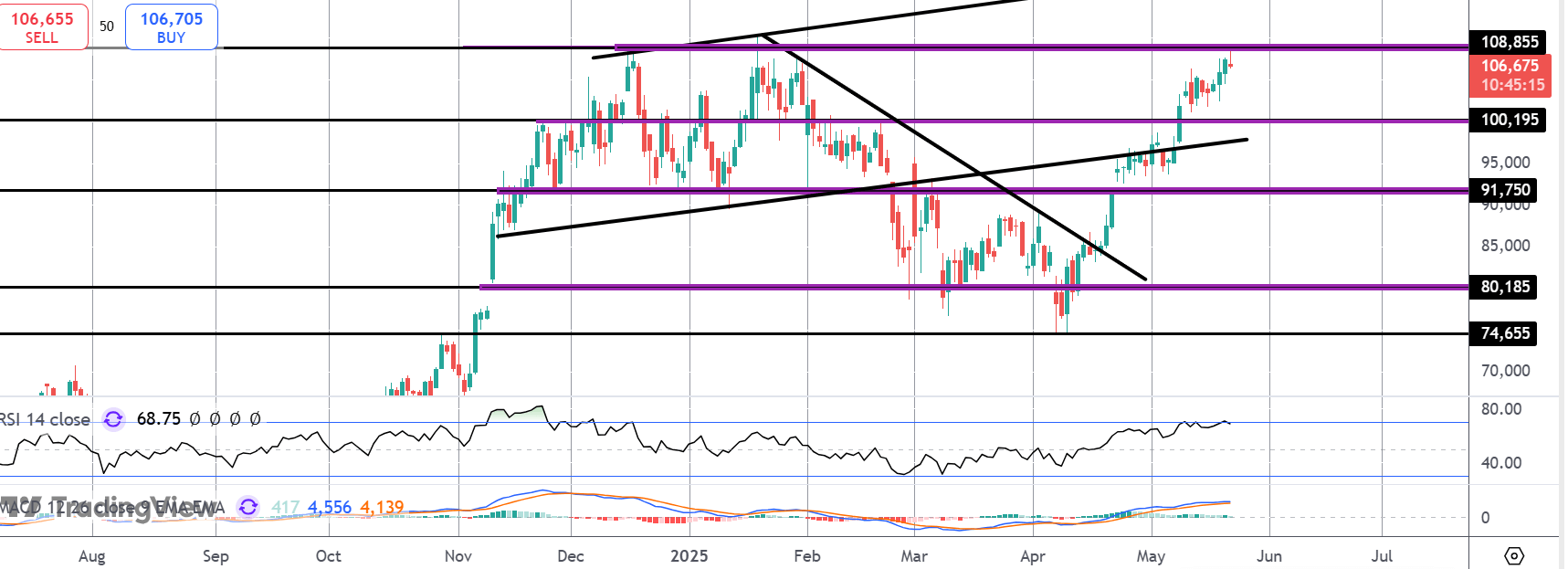

Technical Views

BTC

The rally in BTC has stalled for now into a fresh test of the $108,855 level resistance, just below all-time highs. While some profit taking and reactive selling is to be expected here, the focus remains on a fresh break higher while price holds above the $100k mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.